Payment Processing Quotes

Compare preferential card processing fees from multiple trusted payment processors

- Receive preferential rates from trusted payment processors

- Compare multiple merchant service providers from a single source

- Back up support throughout the agreement with the provider you choose

Some of our partner providers include

Compare and reduce payment processing fees in 3 easy steps

Fill in our short form

Fill in our short form above and one of our payment experts will be in contact to confirm your requirements. You can also book a convenient callback time.

Compare bespoke quotes

After the brief discovery call with one of our payment consultants, you’ll receive the latest and most competitive quotes tailored to your specific needs.

Select the best offer & switch

Compare offers from our tried and tested providers and decide which is the best for your business. If you proceed, we’ll support you through the life of the contract.

Multichannel

Lower your card processing fees on all sales channels

Whether you want to accept payments in person, online or over the phone we can help you find the best solution for your business.

In Person

Accept credit cards and digital wallets on card terminals right for your business

At the table with a portable machine connected via Wi-Fi, Bluetooth or 3G

On the go with a mobile machine using a SIM card with 3G or GPRS

With a countertop terminal connected to a phone line or broadband router

Online

Browser-based checkouts for desktops, tablets and mobiles

Hosted by the payment processor or integrated into your website via an API

Integrate with your existing payment gateway or ecommerce platform

Take international payments and process payments in local currencies

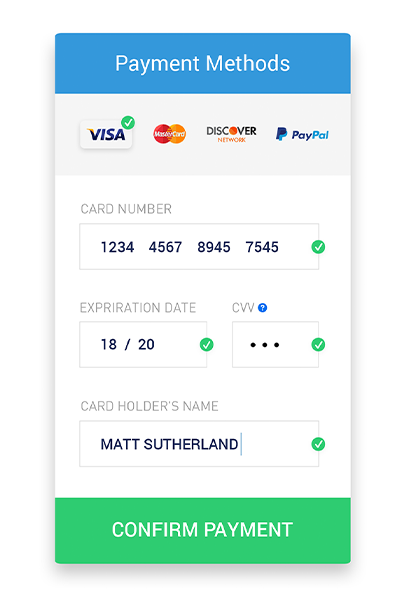

Phone

Take payments over the phone securely via a virtual terminal

Process electronic payments via telephone, email, mail order

No website required - use the virtual terminal on a mobile, tablet or PC

Fully PCI compliant with Address Verification System (AVS)

Why use Merchant Savvy

Preferential card processing rates

Our buying power and long-established relationships with merchant service providers mean we can secure your business preferential payment processing rates that will be cheaper than going direct.

Expert Advice

All of our payment consultants have years of experience negotiating fees and scrutinising contracts. We’re happy to thoroughly check any provider’s contractual terms, fees and advise on any potential pitfalls and suitable alternatives.

Market Access

Privacy Pledge

Your privacy matters to us. We pledge not to sell or share your information with lead generation companies or related businesses. You’ll only deal with us. That means no annoying calls, texts, or emails.

Independent & Unbiased

Our advice and recommendations will be open, honest and unbiased. Whilst we have our preferred payment providers, we have no allegiance to any of them.

Peace of Mind

If you choose one of our approved providers, you have the peace of mind that we are available at any time during your agreement to help resolve any issues you may have.

Here are some of our latest reviews from businesses that we’ve helped

See more reviews on Trustpilot here

Excellent service - narrowed down suitable options for us to consider to two. We are very pleased with our new provider and would recommend Independent Merchant Services to provide truly independent comparisons - and for free! What is there not to like?

Roger and team are simply excellent in guiding you through the cesspool of payment providers, promising one thing and getting you to sign up to another. Genuinely knowledgable and refreshingly independent.

Sometimes you just stumble across a company which is absolutely brilliant and Independent Merchant Services is one of those.

Independent Merchant Services achieved it in 5 days for us.

They really are a 5* and ‘must go to’ company!

Roger managed to not only negotiate better than I could, he led me through the process, especially with regards dealing with the dreaded compliance nightmare.

Great, old-fashioned honesty and straightforward, easy communication, throughout. I recommend this company unreservedly.

Darren was fantastic from start to finish. He made the whole process very easy for us and answered all my questions. Would highly recommend.

From 1st contact with Roger the whole process was seamless. As a small independent business we need to control costs and on Roger's advice we saved a great deal of money and it was an easy process to change suppliers and we were guided through each step fantastically well.

Couldn't recommend them highly enough.

Darren Britcliffe was a pleasure to deal with from beginning to end. Listened to my requirements, understood which solution would fit my business needs the best and followed up all the way through.

Thoroughly recommended.

It was good to be able to talk to someone about our business and what we needed from a payment system. They were then able to advise us and put us in touch with a suitable company that offered really helpful customer support for a small business.

It was great to be able to talk to the same person rather than being passed around to different people who didn't really understand our situation and requirements.

After hearing so many horror stories about companies not keeping the promises and not backing up the talk with action.

I can say that Gavin has been amazing. This was been the easiest money saving exercise I have done for a long time. Thanks one and all!

Much better and cheaper than our last provider and there’s always help from their customer services.

Darren explained the role that he plays and arranged quotes which showed significant savings compared to current provider. It was then easy to accept and change provider.

Gavin was excellent, provided brilliant advice for us to update and make savings on our card terminals. Highly recommended.

Not only were they able to get me a great deal, the service was fantastic from start to finish and Roger was always at the end of the phone to answer any of my questions.

I definitely recommend – Roger you were a great help, thank you.

I approached IMS as I had a 33% hike in fees in two years from Worldpay. don’t deal with cold callers. They asked a few questions about the business, gave two recommendations on new providers of which I chose the slightly more expensive one.

I achieved a 2/3 reduction in fees. Great service throughout.

The recommendation that came back was that we are already on a competitive deal with our existing provider. This is a good indicator that the advice given is impartial and trustworthy.

Extremely helpful in finding a provider that suited my business and cut my costs dramatically. In one phone call Gavin gave me all the facts and figures. Would highly recommend.

Wish I had found this company sooner.

Darren is definitely the man to go to. He gives a full understanding of the best offers available and it has been our pleasure to work with him for our company's advantage.

After hearing so many horror stories about companies not keeping the promises and not backing up the talk with action. I can say that Gavin has been amazing. This was been the easiest money saving exercise I have done for a long time. Thanks one and all!

Great communication. No pushy sales tactics. A very pleasant and easy method of switching card suppliers without the hassleplus they're available after switching if you have any problems or concerns. A good company to deal with.

Fantastic experience! Gavin was approachable, knowledgeable and made the process of choosing a new merchant services provider really simple. He was even on hand after the selection process to help with further queries.

Would highly recommend.

What we will do

- Give you all the facts in one phone call

- Give you an explanation for our recommendations

- Offer support during the contract with the provider

- Independently compare leading payment providers

- Give you access to the most competitive payment processing rates for your specific business

What we won't do

- Hound you with incessant sales calls

- Sell your details to other companies

- Send sales agents to your offices

- Bombard you with endless junk mail

- Charge you for our services

- Be pushy and manipulative with the facts

Multi-Sector

The UK’s reference point in card processing fees with payment solutions for every business model

We’ve advised thousands of businesses of all types in a wide range of sectors including those below.

Reduce your payment processing fees when taking payments in-store and when you sell your products online.

Whether your retail business sells in-store, digitally or both, Merchant Savvy is here to find flexible and low-fee payment solutions for retailers.

Our payments experts can secure you lower card processing rates for payments taken on card machines, EPOS systems, ecommerce platforms and payment gateways. We can also help you get set up with the right hardware or switch suppliers.

From bars and pubs to hotels and restaurants. We can lower your fees on all types of card terminals (countertop, mobile and portable) as well as integrated EPOS systems.

We’ve helped hundreds of new and established hospitality businesses reduce their card processing fees and find the right card machines. Cut down on fees, reduce the complexity of your contracts and find a payment partner that can scale with your business.No matter what digital platform you’ve built on (or plan to) we can secure very competitive rates for accepting card payments online.

Whether you’re a large multi-national brand looking to investigate if more competitive rates are possible, or a startup launching their online business, our payments experts can help. We can find a payment provider that can integrate with your existing set-up whilst lowering transaction fees and offering better contract terms. We can also help you get set up if you are just starting out. Ecommerce solutions are always evolving with advances in technology and changes in customer behaviour.Are you looking to accept credit cards for your small business and are not sure of the best solution? We get it.

Comparing providers and fees is time-consuming and confusing. That’s why Merchant Savvy is here.

Our payment experts will find you the lowest processing fees from a payment processor that is a good fit for your specific business. You can then focus on growing your business whilst keeping more of your hard-earned revenue.

If your business is struggling to get a standard merchant account and is deemed high risk you have fewer providers to choose from and are likely to pay higher card processing fees.

We can help you get approved for a reputable high risk merchant account provider providers and keep these fees to a minimum.

We’ve advised hundreds of businesses deemed high risk including travel agencies, debt management agencies, lenders and crypto exchanges.

Retail

Retail

Reduce your payment processing fees when taking payments in-store and when you sell your products online.

Whether your retail business sells in-store, digitally or both, Merchant Savvy is here to find flexible and low-fee payment solutions for retailers.

Our payments experts can secure you lower card processing rates for payments taken on card machines, EPOS systems, E-commerce platforms and payment gateways. We can also help you get set up with the right hardware or switch suppliers.

Food & Beverage

From bars and pubs to hotels and restaurants. We can lower your fees on all types of card terminals (countertop, mobile and portable) as well as integrated EPOS systems.

We’ve helped hundreds of new and established hospitality businesses reduce their card processing fees and find the right card machines.

Cut down on fees, reduce the complexity of your contracts and find a payment partner that can scale with your business.

Ecommerce

No matter what digital platform you’ve built on (or plan to) we can secure very competitive rates for accepting card payments online.

Whether you’re a large multi-national brand looking to investigate if more competitive rates are possible, or a startup launching their online business, our payments experts can help.

We can find a payment provider that can integrate with your existing set-up whilst lowering transaction fees and offering better contract terms. We can also help you get set up if you are just starting out.

Ecommerce solutions are always evolving with advances in technology and changes in customer behaviour.

Small Business

Are you looking to accept credit cards for your small business and are not sure of the best solution? We get it.

Comparing providers and fees is time-consuming and confusing. That’s why Merchant Savvy is here.

Our payment experts will find you the lowest processing fees from a payment processor that is a good fit for your specific business. You can then focus on growing your business whilst keeping more of your hard-earned revenue.

High Risk

If your business is struggling to get a standard merchant account and is deemed high risk you have fewer providers to choose from and are likely to pay higher card processing fees.

We can help you get approved by our trusted reputable providers and keep these fees to a minimum.

We’ve advised hundreds of businesses deemed high risk including travel agencies, debt management agencies, lenders and crypto exchanges.