Compare Payment Processors

Best EPOS systems for UK businesses

The best POS system for your business will depend on your specific business type as well as the number of locations and registers required.The EPOS systems listed below are suited to different types of sectors, requirements, business characteristics and budgets. We will list the best POS systems in various categories which hopefully cover the majority of readers who are trying to find the best solution for their UK business.

You may also be interested in our guides to the best restaurant POS systems and best retail EPOS systems where we go into more detail about the options available.

|  | ||

|---|---|---|---|

Lightspeed POS | Epos Now POS | Square POS | |

|  |  | |

View Details | View Details | View Details | |

Price Plans (excl VAT) | Starter: £59/month Essential: £109/month Premium: £339/month Enterprise: Custom | £225 Upfront then from £54/month (bespoke for each business) | Free: £0 Plus: £49-£69/month Premium: Custom fees* *When annual card sales exceed £200K |

Minimum Contract | 12 months | 12 months | None |

Payment processing Fees (% per UK card transaction) | Zettle: 1.75%

Lightspeed Payments: 2.6%-2.9% + 10¢ | Bespoke | Free Plan: 1.75% Plus Plan: 1.6% Premium Plan: Bespoke |

Payment Processor Integrations (UK) | Zettle | Worldpay Paymentsense Take payments RMS | Square |

Accounting Software Integration | Xero QuickBooks Plus 6 others | Xero QuickBooks Sage | Xero Kashflow Quickfile Commerce Sync |

Support Available | Phone & Live Chat 24/7 | Phone & Live Chat Weekdays 9am – 6pm | Phone Weekdays 9am – 5pm |

Hardware | Proprietary & 3rd party | Proprietary | Proprietary |

Best For | Established small businesses with multiple locations | Single site small businesses | Single site businesses & start-ups |

Best EPOS systems for UK businesses

The best POS system for your business will depend on your specific business type as well as the number of locations and registers required.The EPOS systems listed below are suited to different types of sectors, requirements, business characteristics and budgets. We will list the best POS systems in various categories which hopefully cover the majority of readers who are trying to find the best solution for their UK business.

You may also be interested in our guides to the best restaurant POS systems and best retail EPOS systems where we go into more detail about the options available.

Compare Popular EPOS systems for UK SMEs

Pros:

- All-in-one solution suitable for many industries

- Omnichannel-capable with online ordering and e-commerce integrations (Shopify, Bigcommerce & WooCommerce)

- One-on-one onboarding support with 24/7 support

- Consistently positive customer reviews

- Multiple payment processor integration options

Cons:

- 12-month minimum contract

- Monthly costs for some of the hardware

- Target Sectors: Retail & Hospitality

- Type: Software and Hardware

- Minimum Contract Length: 12 months

- Free Trial: None

- Monthly Fees: From £54 per month with 12-month contact

- Hardware Costs

- Complete solution for £325 upfront (discounted from £899): Two-screen POS terminal, with 15.6″ full HD touchscreen. 10.1″ HD customer touchscreen, in-built 80mm receipt printer, cash drawer.

- Ipad Bundle for £349 upfront: Apple iPad (9th gen) 10.2” tablet, Epos Now Software, stand, printer, card machine

- Android Bundle for £149 upfront: Lenovo Tab M10 Android tablet, Epos Now Software, stand, printer, card machine

- Kitchen display system (KDS) from £199 upfront plus £29 per month or £49 per month and nothing upfront.

- Handheld POS terminals from £19 per month (Verifone p400, Castles Saturn 1000)

- Card-present transaction fee: Fixed flat rate (non-disclosed)

- Online transaction fee: N/A

- Payment Processor Partners: Epos Now Payments or 3rd party payment processors (Worldpay, Paymentsense, Take Payments or RMS)

- Accounting software integration: Xero, Quickbooks and Sage

- Hospitality features and apps:

- Kitchen display system software only for £19/month

- Delivery and collection mobile app powered by Yoello

- Delivery app powered by Otter that integrates with Just Eat, Deliveroo and UberEats

- Hotel PMS integration with Caterbook

- Retail software features and apps:

- Remote ordering, collection and delivery

- E-commerce integration with Wix, Shopify, BigCommerce, WooCommerce

- Real-time Inventory management

- Loyalty, voucher and gift card apps

- Support: 24/7 technical support plus community forums and online knowledgebase

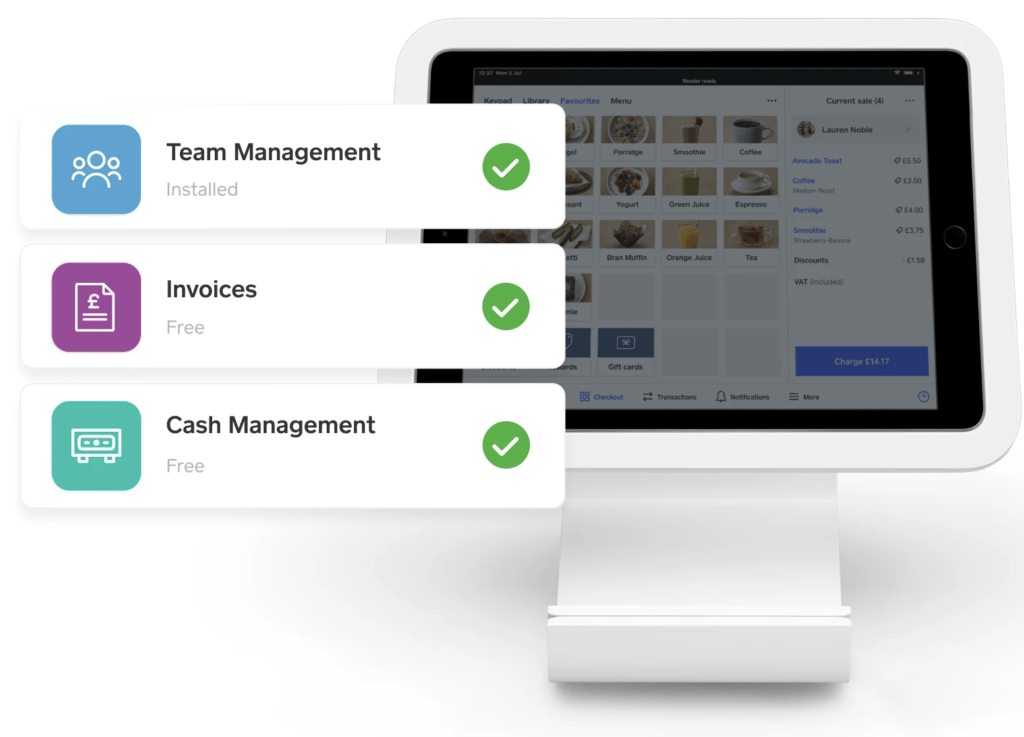

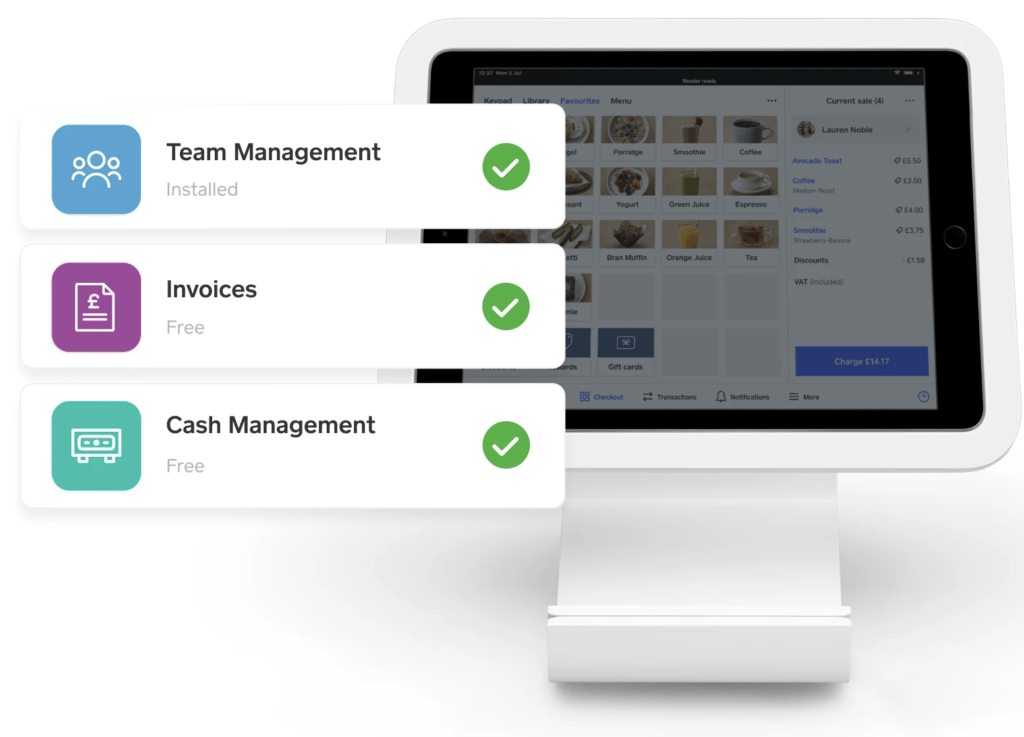

EposNow is a global EPOS provider headquartered in Norwich, UK, and is shifting its business model from focusing on upfront sales to recurring revenue. In 2023 their UK division grew its annual turnover by 12% to £38 million and increased the number of customers by 31% to 43,405.

EposNow offers proprietary hardware bundles and a feature-rich business management tool with point-of-sale functionality, embedded finance, stock control, employee management, booking and customer management services. They are best suited to established retail and hospitality businesses looking for a complete EPOS solution with omnichannel capabilities. Simple integrations with the most popular cloud-based accountancy and marketing software are also possible.

With one of the most consistent Trustpilot review pages, EposNow is a robust choice for UK businesses happy to commit to an annual contract, especially those wanting to use Worldpay, Paymentsense, Take Payments or RMS for payment processing.

Shortlist EposNow if:

- You want feature-rich software and robust hardware

- Want a reliable, versatile option

- You already use Worldpay, Paymentsense, Take Payments or RMS for payment processing

Don’t Use EposNow if:

- You don’t want to be tied into a monthly contract

- You are just looking for a simple system that you can install on an iPad or Android tablet

What kind of businesses should consider EposNow?

Busy high-turnover restaurants or established retail stores requiring multiple POS tills and terminals.

What we like about EposNow: Comprehensive suite of high-quality POS hardware for retailers, restaurants and other hospitality businesses. The option for businesses to use 3rd party payment processors is also a big plus due to the potential savings this may bring and the ability to have one merchant account for all sales channels.

Square POS

Pros:

- A free plan

- Transparent payment processing fees

- No minimum term

- No authorisation or chargeback fees

- Integration with several major accounting software

- Highly intuitive set-up and easy-to-use interface

Cons:

- Relatively expensive payment processing fees

- Unreliable customer support response times

- Many reviews claim Square withheld funds

- No payment processing options outside of Square

- Target Sectors: Retail, Restaurants & Service Businesses

- Type: Software and Hardware

- Minimum Contract Length: No minimum term

- Free Trial: 30-day trial for the retail Plus plan

- Monthly Fees:

- Free

- Plus: £69 per month

- Premium: Custom monthly fees

- Hardware Costs:

- Square Register: £599 + VAT (or pay monthly instalments over 12 months for no extra cost). This includes two displays: one for the cashier and one for the customer. A card machine is built into the customer-facing screen.

- Square Terminal: £149 + VAT (a six-month instalment plan is available). This includes a 5.5” display that has a built-in card machine with receipt printing.

- Square Stand: £99 + VAT (a six-month instalment plan is available). This includes an iPad POS with a built-in card reader. There’s a USB hub and Bluetooth to connect to a printer, cash drawer, or barcode scanner (none of which are included)

- Square Reader: £19 + VAT for a chip and pin reader with contactless capability.

- Card-present transaction fees:

- Free Plan: 1.75%

- Plus Plan: 1.75% (1.60% when using Square Retail POS)

- Premium: Bespoke (Below 1.60%)

- Online transaction fee:

- 1.4% + 25p (UK cards)

- 2.5% + 25p (non-UK cards)

- Payment Processor Partners: Proprietary

- Accounting software integration: Xero, Sage, QuickBooks, Kashflow, Quickfile, Commerce Sync

- Hospitality features and apps:

- Online ordering for takeaways

- Kitchen Display system for managing orders

- Automatically print tickets for the kitchen

- Integrations with platforms like Uber Eats and Deliveroo

- Retail software features and apps

- Inventory management reports

- Automatically purchase orders

- Employee time tracking

- Sell online with easy website integration

- Appointment features and apps

- Manage availability and allow customers to book appointments

- Flexible POS options

- Waitlist features

- Support: Some lines are open 24/7 depending on the type of support, but many are Monday to Friday.

Square has been building its strong reputation since 2009 and is known today for being user-friendly and with transparent pricing. It has become a popular option for SMEs wanting a low-commitment way to accept payments online and in person.

Square POS has a broad appeal to a wide range of industries thanks to its range of hardware and e-commerce capabilities. Despite some negative reviews around customer support and withholding funds, Square should be on the shortlist of startups and low-turnover businesses.

Shortlist Square POS if:

- Having no minimum term is important

- You are looking for a simple, accessible system

- You want to try a free EPOS system

- You sell both online and in-person

Don’t use Square POS if:

- You’re a large company looking for a solution that scales

- Looking for third-party payment processing integration

- You expect to process more than £50,000 in card sales by EPOS annually (in which case you are better off getting a system with cheaper transaction fees).

What kind of businesses should consider Square?

Micro businesses that are looking for a pay-as-you-go solution with no contractual tie-ins.

What we like Square POS: Very accessible for start-ups due to its user interface, easy set-up, and no upfront fees.

Lightspeed

Pros:

- Customisable with good usability

- Strong reporting

- Specific focus on retail and hospitality separately

- Good multi-location support

Cons:

- Many fundamental features are only for more expensive tiers

- Poor mobile app reviews (Android and IOS)

- Expensive transaction fees

- £15 per chargeback

- Target Sectors: Retail, E-commerce, Restaurants, Golf

- Type: Software and Hardware

- Minimum Contract Length: 12 months

- Sign Up offer: Get up to £500 of hardware for free

- Monthly Fees (Restaurant):

- Starter: £59/month

- Essential: £79/month

- Premium: £109/month

- Enterprise: Custom

- Monthly Fees (Retail):

- Lean: £59/month

- Standard: £79/month

- Advanced: £199/month

- Enterprise: Custom

- Card-present transaction fee: Lightspeed Payment charges n 2.6% to 2.9% plus 10¢ (approximately £0.08) for each transaction.

- Payment Processor Partners: None. They use Lightspeed Payments.

- Accounting software integration: Xero, Quickbooks, Sage, and several others.

- Hospitality features and apps:

- Online and tableside ordering

- PMS integration for multiple locations (including hotels)

- Customisable menus and floor plans

- Real-time insights for staff and menu performance

- Retail software features and apps:

- A single platform to manage suppliers, teams, inventory, and multiple stores

- E-commerce and Zettle integrations

- Multi-store capabilities with real-time insights

- Advanced stock management and sales analysis for all plans

- Reward customer loyalty and automate marketing

- Support: 24/7 technical support

Lightspeed is a two-billion-dollar POS company that is based in Montreal, Canada. The Lighspeed retail and restaurant platforms have four plans, a wide range of possible integrations and the options to use external payment processors making it one of the most versatile POS systems available.

The cheaper packages lack basic features such as accounting, real-time reporting and ecommerce and you will need to pay for the higher tiers to access loyalty and advanced reporting.

What kind of businesses should consider Lightspeed?

Established SMEs with multiple locations looking to streamline their payments.

What we like about Lightspeed: They offer comprehensive POS software and hardware solutions for multi-location businesses.

Shopify POS

Pros:

- Easy to integrate online and in-store sales

- Fast onboarding and no contractual commitment

- Portable POS hardware with plug-and-play capability

- Strong support

- Transparent pricing

Cons:

- Doesn’t cater to hospitality

- Lacks an enterprise focus with some functionality being limited

- Transaction fees are relatively high (even if using a 3rd party processor due to their 0.6%-2% markup).

- Target Sectors: Retail

- Type: Software and Hardware

- Minimum Contract Length: None

- Free Trial: £1 for your first month or a 6-month discount on POS Pro for £50 per month

- Monthly Fees:

- Basic Shopify: £25 (£19 when billed annually)

- Shopify: £65 (£49 when billed annually)

- Advanced Shopify: £344 (£259 when billed annually)

- Plus: custom pricing starting at $2,300 per month on a 3-year term

- Hardware Costs:

- Countertop Kit: £279

- POS Terminal: £199

- POS Go: £169

- WisePad 3 Card Reader: £49

- Card-present transaction fees:

- 1.70% +25p for Basic Shopify

- 1.60% +25p for Shopify

- 1.50% +25p for Advanced Shopify

- Online transaction fees:

- 2% + 25p for Basic Shopify

- 1.70% + 25p for Shopify

- 1.50% + 25p for Advanced Shopify

- Payment Processor Partners: Adyen, PayPal, Stripe, Opayo, WorldPay, and many others

- Fees for Using a Payment Processor Partners (in addition to the 3rd party processor fees):

- 2% for Basic Shopify

- 1% for Shopify

- 0.60% for Advanced Shopify

- Accounting software integration: Xero, Quickbooks, FreshBooks, Sage, and more

- Features and apps:

- Powerful e-commerce integration with shop-hosting

- Customisable POS terminal with omnichannel selling

- Staff management with time-tracking features

- Strong reporting and analysis

- Support: 24/7 support over email, phone, and chat

Shopify needs very little introduction, with the Canadian startup getting its unicorn status back in 2013. With it being an ecommerce platform first and foremost, this is where many of its best features come from.

However, Shopify performs well as a stand-alone POS solution for single-site retailers and start-ups. There are no minimum contracts (although you get cheaper fees with annual plans), monthly fees are low, and hardware and transaction costs are reasonable. The many payment processor integration options provide flexibility.

Whilst it does well as an accessible EPOS system, it isn’t ideal for enterprise solutions. They do have a Plus package, but the customer service and lack of bespoke service may be a deal breaker for larger companies.

Shortlist Shopify if:

- You want a fast option that is accessible

- Are looking to pay more for flexibility, ease of use, and strong integrations

Don’t Use Shopify if:

- You are in the hospitality industry

- You’re looking for a large-scale, bespoke solution

- Low transaction fees are important

What kind of businesses should consider Shopify?

Smaller single-site retail outlets with both online and offline sales, along with pop-ups and mobile retailers.

What we like: Shopify has incredible software out of the box, making it extremely accessible to people who are new to POS systems.

Zettle by Paypal POS

Pros:

- No monthly fees or contracts

- Tap to pay, plus a high-performing mobile app

- Consistent, transparent transaction fees

- Convenient for PayPal users

Cons:

- Unpredictable customer service

- Reports of unreliable hardware

- Limited to small businesses and lacks hospitality features

- Target Sectors: Hospitality and Retail

- Type: Software and Hardware

- Minimum Contract Length: None

- Free Trial: None

- Monthly Fees: None

- Hardware Costs:

- POS Terminal with 4G connection: from £149 plus VAT (Additional £50 for more features and a built-in barcode scanner)

- Reader 2: £56

- Dock 2: £38

- Barcode Scanner: £209

- Cash Drawer: £49

- iPad WiFi: £307 or iPad 4G £432

- Zettle Store Kit Mini: from £189 plus VAT

- Zettle Store Kit: £351 base price plus VAT

- Card-present transaction fee: Fixed flat rate of 1.75%. Custom pricing for businesses with over £10,000 in monthly card payments.

- Online transaction fee: Rates vary using PayPal. Payment Links are 2.50%

- Payment Processor Partners: PayPal

- Accounting software integration: PayPal

- Features and apps:

- Strong e-commerce integration

- Sales reporting and staff performance tracking

- Seamless PayPal integration

- Easy refunds and strong security infrastructure

- Strong mobile performance

- Support: 9.00 am – 5.00 pm (Monday – Friday)

Zettle (previously iZettle) is a Swedish fintech company that was acquired by PayPal in 2018. Zettle excels in being a lightweight and accessible option, with no monthly fees and no minimum contract term.

It’s a simple solution, much like PayPal. But, you’re forced into using PayPal’s ecosystem, which has its upsides and downsides.

Zettle has mixed reports on its customer service. It claims to serve hospitality clients but cannot match competitors in terms of features, like kitchen display units and advanced seating management. But, for mobile businesses or existing users of PayPal, Zettle is a low-risk option.

Shortlist Zettle if:

- Already a PayPal user

Don’t Use Zettle if:

- You want to avoid high upfront costs

- You sell high-ticket items

What kind of businesses should consider Zettle?

Pop-ups and low-turnover businesses will suit Zettle, as well as those already using PayPal.

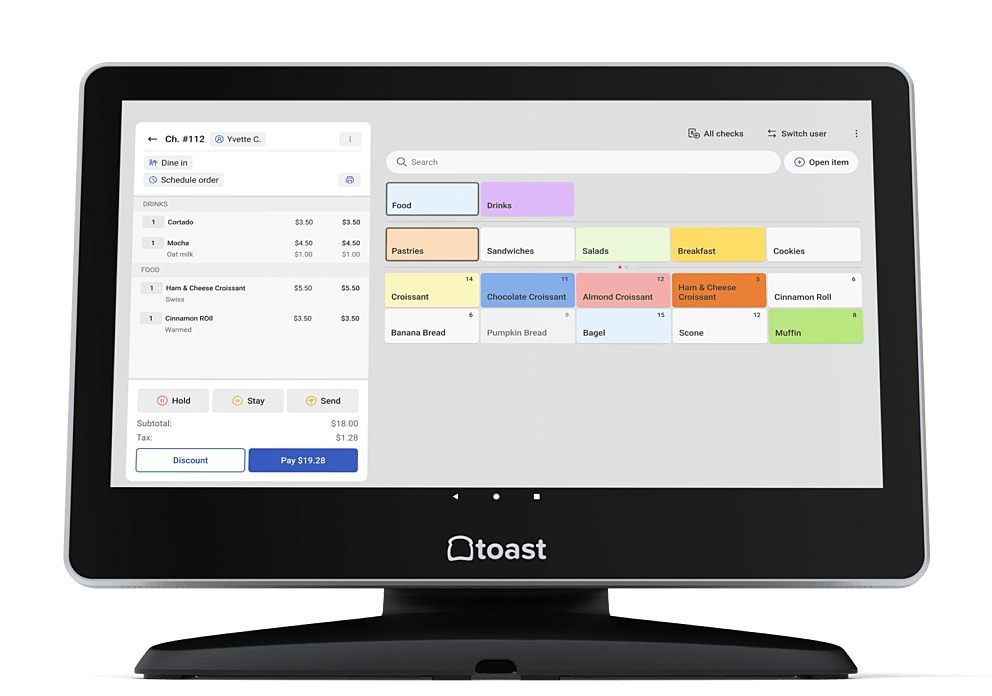

Toast POS

Pros:

- Free customer care, including online training, webinars, and a knowledgebase

- Restaurant-grade hardware (e.g. drop-proof)

- Can easily adapt to menu challenges quickly

- Table management with real-time analytics

Cons:

- Limited focus on restaurants

- Software lacks simplicity

- Reports of payroll issues

- Expensive, particularly for smaller companies

- Android-only & app isn’t on the Play Store (manual download required)

- Target Sector: Restaurants

- Type: Software and Hardware

- Minimum Contract Length: Varies

- Free Trial: None

- Monthly Fees:

- Starter: £80 per month

- Essentials: £150 per month

- Custom

- Hardware Costs:

- One mobile terminal (Toast Go 2) and a kitchen display system are included in the Essential plan. They do not publish prices for adding additional hardware.

- Card-present transaction fee: Bespoke rates on request

- Online transaction fee: Bespoke rates on request

- Payment Processor Partners: None. It is a payment facilitator.

- Accounting software integration: None directly, but can interact with the major accounting providers via API.

- Features and apps

- Handheld tableside ordering and bill splitting

- Kitchen display system with digital ordering integration

- 4G, WiFi, and offline mode

- In-app alerts for order status

- Strong menu management

- Multi-location management

- Support: 24/7 support plus training and installation support. Option for on-site implementation.

Despite being a fairly unknown cloud-based provider in the UK, Toast is a $10+ billion company based in Boston, and had one of the largest IPOs in history.

Consumer experiences haven’t quite lived up to the investor hype yet, with very mixed reviews and many claims of lacklustre customer service. As per its name, Toast is mainly focused on serving restaurants, but it’s still relatively new to the British market

Whilst their US service has a free tier, their POS pricing begins at £80/month for UK businesses.

Toast does perform well when it comes to offering good support for all packages due to an emphasis on installation support. Lots of great restaurant features exist for all packages too.

Shortlist Toast if:

- You are a multi-chain restaurant owner

- Want a comprehensive solution with strong support

Don’t Use Toast if:

- You sell food out of a mobile food van or pop-up locations

- Looking for a low-cost, minimal solution

What kind of businesses should consider Toast?

Toast has many great features, but it may appeal more to established restaurants.

What we like: While Toast’s powerful solution comes with its complexities, it goes above and beyond with its support for all plans.

What is a POS system?

Point of Sale (POS) systems are a way to process sales in person and streamline inventory management.

POS hardware includes card payments and/or cash payments can be received through devices like card readers and cash registers. Barcode scanners and receipt printers are a part of a comprehensive POS system.

POS software often has an inventory system where SKUs are given prices and a stock count. This can allow the system to communicate low-stock alerts and strong-performing products. For hospitality, it’s possible to manage seating space, hotel room occupancy, and generate tickets for kitchen staff.

How much does a POS system cost?

The price of a POS system is made up of fixed and variable costs in three main categories:

- Hardware (often fixed and up-front)

- Software (often ongoing, such as a monthly subscription)

- Processing fees (charged as a % of each transaction)

When it comes to software costs, prices can vary from being free to a couple of hundred pounds per month. Annual payments sometimes yield a discount, but these costs are intended to cover server, cloud, and support costs borne by the provider.

Hardware is sometimes included in the monthly bundle fee or offered at a standalone price. Sometimes a pre-configured bundle can be cheaper, such as having a display, cash register, printer, barcode scanner, and card reader. Usually, add-ons are available for items like a customer-facing display and equipping multiple locations.

Processing fees can either be a fixed percentage + flat fee for all transactions (i.e. 1.7% + 10p) or vary depending on the card used which is typical if using a 3rd party payment processor. Chargebacks can often cost around £10.

Additional costs to consider are features and modules that are behind a paywall, customisation, and support packages. Enterprise solutions can create bespoke pricing, but may also come with implementation, maintenance, or even training costs.

Types of POS Systems

| Types | Benefits | Drawbacks | Who should consider using it |

|---|---|---|---|

| Mobile POS | Portable, flexible, low upfront cost | Limited features, connectivity issues | Food vans, market and festival stalls, pop-up shops |

| Cloud POS | Accessible remotely, from anywhere. Low maintenance costs | Dependend on having an internet connection (an issue for rural markets and festivals). | SMEs looking for convenience, fast onboarding and real-time data |

| Touch-screen POS | Boost customer experience and speed up ordering | High upfront costs and a higher learning curve | Customer-facing businesses. Can also increase gratuities |

| Multichannel POS | Centralising data and Inventory management | Setting up challenges and higher costs | Retailers selling through different channels |

| Self-service POS | Faster service, higher order accuracy and reduced labour costs | High upfront costs and resistance from customers | Restaurants with high foot traffic or are competing on costs |

What makes a good POS system?

A good point of sale (POS) system should make it easy for you to accept and track payments from your customers in person. Whether you need to accept these payments at a fixed till or have a portable POS system for taking payments anywhere on your premises depends on the nature of your business.

Due to the differences in business types, one POS system may be great for one business but cause users to pull their hair out in other businesses. This is the whole point of this article – looking at the best POS systems based on:

- The business size (e.g. the number of staff you employ and how many of them need to take payments)

- The size and diversity of the stock you need to manage and sell

- The type of business (e.g. retail, hospitality etc)

- Your budget

- Hardware preferences

We’ll also be covering what makes each of these POS systems unique, running through their pros and cons as well as suggesting what kind of businesses they’re most suitable for.

Standard POS Hardware

Display Unit

A screen that shows the information from a product, service, checkout basket, or transaction. This unit can face the cashier and/or customer.

Registers

Central to the POS system, registers are the computing power and point of connection for other components to connect to.

Card Terminals (desktop and mobile)

Devices that securely read and accept payments from either cards (Chip & PIN or Contactless) or mobile phones (NFC). These can be a remote device, built into the register or merely the software on a smartphone.

Cash Drawer

The secure drawer that stores cash from cash transactions. It’s connected to the POS system, which can automate its opening.

Receipt Printer

The device that prints transaction receipts for customers to take away as proof of a purchase. These can often have templates, branding, and additional information like a Wi-Fi code.

Barcode Scanner

A scanner (either handheld or static) that reads barcodes and identifies products to the POS system.

Hospitality-Specific POS Hardware

Self-Ordering Kiosks

Interactive computers, often with a large display, where customers can process their own orders and payments.

Kitchen Display Units

Screens that show real-time orders and food prep instructions for kitchen staff.

POS Software Features

Checkout System

Core to a POS system, this is where products are accrued into a basket, a price is tallied up, taxes are calculated, and discounts can be applied.

Payment Processing

Securely process payments from a variety of methods, such as in-person Chip & PIN, online cards, invoices, and potentially keyed-in over the phone. The POS system communicates with the payment gateway/processor who transmits data to the card issuer or bank for authorisation.

Marketing Tools

Features that help increase sales or awareness, such as CRM and keeping track of customer loyalty points. This is often through a partner, like Nectar or in-house like Tesco’s Clubcard.

Inventory Management

A database and data pipeline where stock is counted, automatically updated upon sales and chargebacks, and reports are generated to optimise stock management. This may be by highlighting seasonality, where stock could be lower during winter.

Staff Management

Features that allow for managing employees’ schedules, tracking their hours, controlling their access, and communicating with HR. This may also be used for commissions and bonuses, as well as checking for missing cash during a certain shift.

Reporting & Analytics

Lots of data is entered and held on a POS system, and good data analysis can provide insights into customer behaviour, staff behaviour, the market, operational efficiency, and business performance KPIs.

Omnichannel system

Some businesses sell in stores and online, and an omnichannel system helps centralise this data and streamline the orders, inventory management, and data. It simplifies accounting but can be combined with analytics to show performance between different revenue streams.

Customer Relationship Management

A CRM helps collect customer data, often for marketing purposes. This data can be analysed to reward loyalty, reach out to customers who have disappeared for a while, or generally personalise customer experience.

Multi-location management

Features that help synchronise data between different outlets or franchises. A different POS system for each location would waste time, so these features help manage a sub-POS system for each location, but keep them connected.

Loyalty program

Features that help reward loyalty to help increase repeat customers. This can be as simple as “for every four coffees, the fifth is free” across any of the franchised outlets.

Table or menu management

A restaurant may have 30 items on its menu and 60 seats for customers, so strong features are needed to help alert a waiter that a certain dessert is out of stock, or perhaps speed up a table’s bill because they’re going to clash with a reservation.

How to choose an EPOS system

Budget

Budget is a key constraint when implementing a new system. In order to effectively assess whether a POS system is within your budget, all costs must be factored in.

Upfront costs, hardware, monthly fees, transaction fees, plus any accessories required need to be taken into account. Also, weigh up if subscribing to a more expensive plan will save money in the long run by reducing the transaction fees. Longer-term contracts will also come with cheaper monthly fees and potentially lower transaction fees.

Preferred Payment Processor

Consider whether you are happy to use the EPOS provider’s integrated payment processing services (i.e. Square POS has fixed transaction fees). Otherwise, with some EPOS providers, you can use an external payment processor which can often have cheaper card processing fees (i.e. use Epos Now for the POS hardware and software and integrate with Worldpay for payment processing).

Hardware required

EPOS providers will either offer their own proprietary POS hardware, hardware from other manufacturers, or a combination of the two.

Software features required

Powerful reporting and staff analysis may sound appealing, but it can come at a high cost. Consider what value you can get out of such insights. On the other hand, if you’re a small solo store with ambitious growth plans, consider future-proofing your decision with a versatile cloud solution.

Contract period

Longer contract periods will often reduce monthly or annual software fees. SCome EPOS providers will also offer lower transaction fees when longer contracts are agreed.

Software integrations

Integrations can be a deal breaker, particularly when it comes to existing accounting software. Consider any immediate deal breakers, but also future scope for integrations (i.e. e-commerce for a fashion outlet with plans to expand).

What are the benefits of using a POS system?

A POS system can have many advantages. An immediate benefit can be for the customer, who may now have more payment options, to have a faster and potentially interactive experience.

For the business, intuitive payment processing, seamless accounting integrations, inventory tracking and real-time analytics are all significant benefits of the best POS systems.

Choosing the right POS system can help centralise data, optimise processes, and engage better with customers.

Jump to:

Payment Solutions

Merchant Finance

Copyright © ALL RIGHTS RESERVED 2023

Merchant Savvy is a division of VUBO Ltd (Company Number 09017066).

Address: Spaces, 9 Greyfriars Rd, Reading, RG1 1NU.

Payment Solutions

Merchant Finance

Copyright © ALL RIGHTS RESERVED 2023

Merchant Savvy is a division of VUBO Ltd (Company Number 09017066).

Address: Spaces, 9 Greyfriars Rd, Reading, RG1 1NU.