Compare Payment Processors

Compare payment processors and secure the lowest payment processing fees for your business

- Receive preferential rates from trusted payment processors

- Compare multiple merchant service providers from a single source

- Back up support throughout the agreement with the provider you choose

You'll only deal with us. We are not a lead generation company.

No multiple sales agents. No call centres. No referring your details.

Compare payment processors and secure the lowest payment processing fees for your business

What is an ISO payment processor and should I use one?

During your research you may come across one of the 60+ Independent Sales Organisations (ISOs) in operation in the UK. ISOs are also known as merchant service providers and popular names include Handepay, Paymentsense, RMS, takepayments and UTP.

ISOs now account for over 50% of all new customer acquisitions for card acquirers.

The 5 largest ISOs in the UK are Paymentsense, Takepayments (formally Payzone), Handepay, UTP and RMS.

Over 90% of businesses that ISOs onboard for card acquirers have an annual card turnover of less than £380,000. As the turnover of a business increases above this level, the more likely businesses are to go to merchant acquirers directly.

An ISO is a third-party company that may recommend or refer you, the merchant, to particular merchant acquirers services. This guide will help you understand what ISOs are and where they fit in the payment processing ecosystem.

What are ISOs?

They offer a package of goods and services that together enable a merchant to accept card payments but they essentially perform an outsourced sales function for merchant acquirers.

Acquiring banks can outsource sales functions to ISOs, signing up new merchants in exchange for a commission. Acquirers typically demand or incentivise ISOs to meet targets for new referrals or revenues. Unlike other third parties that refer merchants to acquirers, ISOs are allowed to negotiate pricing with merchants for card-acquiring services. ISOs can work with more than one acquirer but rarely do.

You can see a list of popular ISO’s and full service payment processors here.

What services do they provide?

ISO’s sit in the middle of the payment system, forming agreements with acquiring banks to handle merchant accounts on their behalf and building relationships with merchants.

An ISO payment processor provides support to a merchant to complete and submit their application to an acquirer for a merchant account. An ISO can provide ongoing services to the merchant once the account is set up, rather than the acquirer.

Some ISOs also offer payment gateways and value-added services, such as services to help the merchant certify their compliance with card payment industry rules including the Payment Card Industry Data Security Standard (PCI DSS).

Their Interdependence With Acquirers

There are often compelling commercial incentives for ISOs to use just one acquirer to provide merchant accounts and card-acquiring services. This means they won’t look around for those offering the most competitive rates for your specific business (like we do).

In the past, acquiring banks were happy to sign up businesses with low to medium levels of card turnover but many have chosen to outsource the marketing and onboarding of new SMEs to ISOs and pay them a commission.

ISOs now account for over 50% of all new customer acquisitions for card acquirers.

Many merchant acquirers would rather have their corporate sales team focus on attracting and developing relationships with larger businesses which make up the majority of transactions (businesses with an annual card turnover above £10m account for over 80% of the volume and value of transactions even though they only make up 0.3% of all businesses).

How do they make their money?

Most ISOs make the majority of their revenue (typically around 60%) from the commission paid by acquirers in exchange for onboarding customers to their card-acquiring services. This commission is normally paid monthly and calculated as a percentage of card turnover.

The rest of their money comes from POS hardware rental (either supplied directly or via a 3rd party supplier which pays commissions), monthly payment gateway fees or other value-added services.

Typical ISO merchant services include:

- Merchant account application assistance

- Account setup

- Customer support

- Credit card processing

- Online gateways

- Hardware (terminals, etc.)

- Software (POS systems)

- Analytics programs

- Mobile readers and apps

- Assisting in handling disputes and chargebacks

- PCI compliance.

Which business types should consider using an ISO?

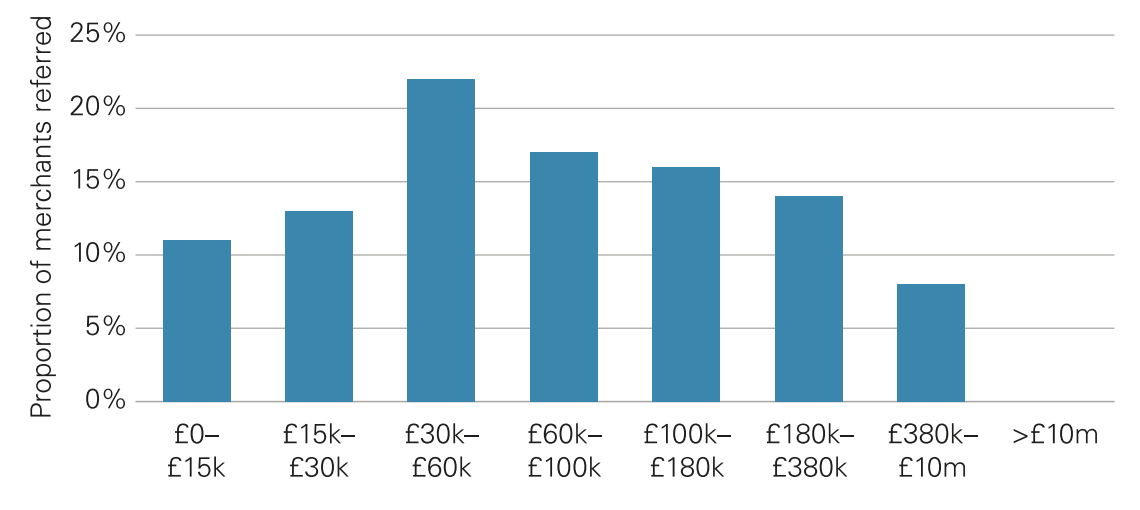

Over 90% of businesses that ISO’s onboard for card acquirers have an annual card turnover of less than £380,000. As the turnover of a business increases above this level, the more likely businesses are to go to acquirers directly.

With ISOs providing various value-added services, they are mostly suited to SMEs that are looking for a one-stop shop for all their card processing needs. That is reflected in the fact that ISOs refer around half of the new merchants that acquirers serve with an annual face-to-face card turnover up to £1 million.

Chart: Annual card turnover in 2018 of merchants referred by ISOs to four of the five largest acquirers

Are ISOs the same as MSPs?

ISOs are a type of merchant service provider (MSP), along with acquirers and third-party payment facilitators. ‘Merchant service provider’ is a broad term for companies that have agreements with acquiring banks and sell services to merchants.

But there can be some confusion surrounding the meaning of MSP, as Mastercard refers to the merchant account providers it approves as Member Service Providers/MSPs, in the same way that Visa refers to the merchant account providers it approves as ISOs.

The trouble with (some) ISOs/resellers

If you are considering using an ISO payment processor, you should be aware that an important part of their customer acquisition strategy involves field sales or telesales agents cold calling merchants — that is, making unsolicited calls to merchants by phone or by visiting their place of business.

Many ISOs use a large network of self-employed sales reps who work independently to seek out small businesses to get them to sign long-term card processing or card terminal contracts. Their card processing rates are often uncompetitive, with less than transparent fees buried deep in long-term agreements.

The sales reps are often paid on a commission-only basis and have been known to employ overly aggressive tactics to make their targets. Even those using permanent sales staff with a base salary have a commission structure that heavily incentivises new sign-ups over long-term customer satisfaction.

We don’t want to tar all ISOs with the same brush but you should keep in mind that the incentive structure at many ISOs is heavily weighted towards maximising profit margins over long-term merchant satisfaction.

What to look for in an ISO

If you do decide to use an ISO payment processor, you should research and compare several different companies to find a good fit with a service that meets your company’s needs and budget.

Technology

Your payment ISO should be able to offer the POS hardware and software you need, whether fixed or mobile, and connect with eCommerce platforms and payment gateways that work well with your online presence. Also consider what value-added services they offer such as data analytics platforms to provide insights that can help your company grow.

Strong security

An ISO payment processor should follow security best practices, such as those set out by PCI DSS, to protect your POS hardware and customers’ card data.

Supported payment types and methods

ISOs can provide additional payment offerings beyond card processing, including electronic transfers, recurring billing and invoicing, so look for these features if they are relevant to your business.

Loyalty program options

ISOs can offer loyalty programmes and gift cards that work with your POS system and include them in your payment data, providing your business with a convenient way to attract and retain customers.

Pricing and fees

ISOs can charge a range of payment processing fees and offer different pricing models. Make sure you are clear on the total cost of a service, look out for hidden fees and shop around. Keep in mind though, that the cheapest option may not be the best, if another service provides customer support and value-added features that will benefit your business.

Should I use an ISO or merchant acquirer?

Most SMEs with an annual card turnover under £500,000 will receive better quotes from an ISO than going directly to their merchant acquirer. The volume of business ISOs place with merchant acquirers means they will be offered better rates than a single business applying directly to a merchant acquirer.

However, we believe the best option would be to use us as we can normally get even lower from the same merchant acquirer. We also get preferential rates due to the volume of business we place but can undercut ISO rates as we don’t have the same margin requirements.

Pros and cons of using ISOs

- Pros: Flexibility; tailored services for SMEs; customer support; strong industry relationships.

- Cons: Outsourcing non-sales activities to other vendors; lower cost services may lack customer support; many ISOs have ties to just one acquirer, limiting their ability to offer competitive rates.

Pros and cons of going direct to merchant acquirers

- Pros: Established banks with trusted reputation; integrated in-house services; lower costs for some merchants as there is no additional ISO commission.

- Cons: Acquirers tend to focus on large businesses and outsource onboarding SMEs to ISOs; some acquirers charge additional fees.

Table: Examples of ISOs

| ISO | Card Acquirer |

| Paymentsense | First Data / Fiserv Their also have their own e-money licence |

| takepayments | Barclaycard |

| Handepay | Evo Payments |

| RMS | Teya |

| UTP | Barclaycard |

| Card Cutters | Evo Payments |

How do you know if a payment processor is an ISO?

If you are unsure whether a payment processor is an ISO check their website footer, which will usually state if they partner with one or more acquirer. Alternatively, their support page will likely include the contact details of their acquirer(s) and other partners such as card terminal providers. If you are still unsure, you should ask them directly.’

Contents

Legals

Copyright © ALL RIGHTS RESERVED 2025

Address: Spaces, 9 Greyfriars Rd, Reading, RG1 1NU

Company Number: 09017066