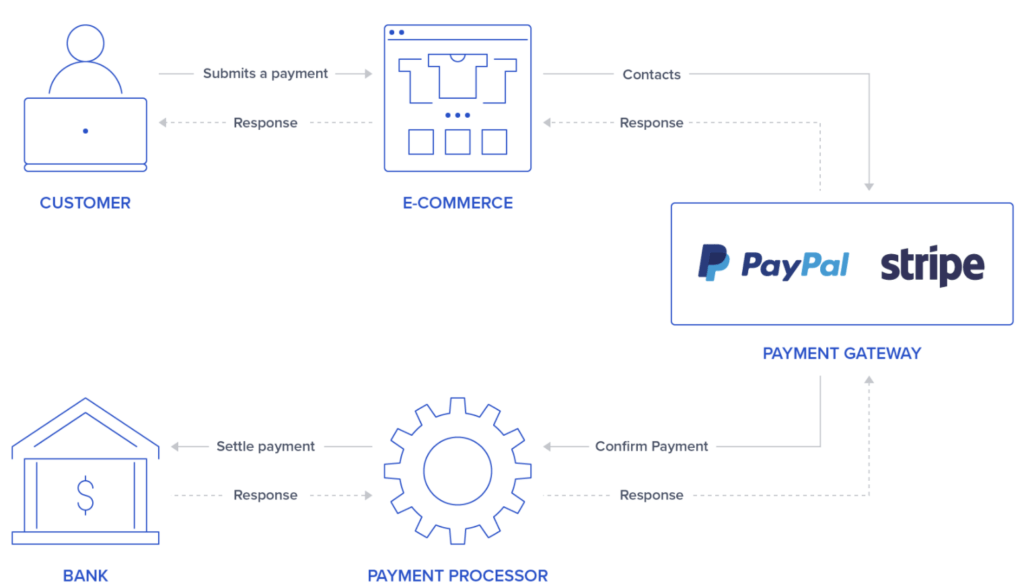

A payment gateway is software that securely captures card payment data from a customer and transfers it to the acquirer (aka merchant account) which results in an approval or disapproval decision being transferred back to the customer.

The cardholder’s bank only submits payments for settlement once they receive approval from the payment gateway.

You will have used a website payment gateway every time you so a bit of online shopping. It is a critical middleman when taking card payments when the card holder is not present (CNP payments).

Most merchant account providers offer their own payment gateway to their customers (and vice versa) but it is often a good idea to investigate whether it may be better to use different companies for your payment gateway and merchant account.

You can get a better user experience, higher conversion rates and lower transaction fees by splitting them (we can give you advice on this based on your business requirements).

How to choose the best payment gateway provider for your business?

This is one question where the answer is ‘it depends’. If you are looking to find the payment payment gateway solution for your businesses these are the factors you need to consider.

1. Compatibility

If you are buying separately from your merchant account provider, you need to make sure you can integrate the two. Similarly, if you are using an eCommerce platform check the integrations possible. If not, then it has failed a key requirement and you should cross it off your shortlist.

2. Checkout experience and ability to customise UX

What is the user experience for entering card details on desktop and mobile devices? 18% of online shoppers in abandoned an order in Q1 2021 due to a checkout process that was too long or complicated.

Customer experience at checkout has a significant impact on your bottom line and a good payment gateway will allow you to improve this.

3. Offering payment options your customer wants

Offering the payment options your customers want to use will reduce friction at the checkout screen and increase sales. This could include adding additional card types like Amex, additional payment methods like Apple Pay or buy now and pay later functionality.

4. Security & fraud prevention

Does it have the level of PCI compliance your specific business requires? As a guide, here is how Visa decide on required PCI levels. Online payments have a reputation of more chargebacks and your gateway wil provider will affect how well fraud is prevented (and save you chargeback costs)

5. Speed of payment

Some gateways are painfully slow to transfer funds so make sure you check how quickly you can expect to access your money once settled (it typically takes 3 days).

6. Reporting & user interface

The user interfaces and reporting of some payment gateways are head a shoulders above others. They are not only intuitive and a joy to use but they can improve your decision making.

7. International coverage

If you are taking international orders it is obviously important to check about the ability to multiple currencies and card types. You should also confirm any additional fees incurred for international payments and if a merchant account in a specific country is required.

You may also be interested in our list of the popular gateways and their fees.

How much do payment gateways cost?

When choosing a payment gateway, make sure you understand their fee structure and the most appropriate option for your business. Look out for hidden fees or restrictions, such as transaction limits.

There are several types of cost associated with a payment gateway that can be split into:

- One-time account setup fee

- Transaction fees

- Fixed monthly account administration charges

- Additional fees, such as chargebacks

You can see some examples of the fees charged in the payment gateways listed above.

The total cost of using a payment gateway will depend on how those different types of fees stack up. Transaction fees include:

- Payment method costs

- Bank and card network charges

- Wire transfer costs

- Currency conversion fees

If you only need to accept a relatively small volume of online payments, look for accounts with no setup costs or monthly account charges. While you want to find a payment gateway service that can scale as your business grows, avoid platforms with complicated functionality that will take time and resources to work with.

Compare different fee structures to see whether percentage fees or flat fees + percentage charges would work out the cheapest for your company’s typical transaction types, sizes and volumes. Large businesses can often negotiate a customised pricing package that factors in a discount for large transaction volumes and sizes.

Payment Gateways vs Payment Processors: What’s the Difference?

In short, payment gateway is software that approves or declines transactions between your website and your customers and a payment processor executes the transaction.

Payment gateways capture and send card data to the payment processor and also communicate approvals or rejections to you and your customers. We cover the differences between payment gateways and payment processors in more detail here.

How is a payment gateway different from a payment service provider?

You may hear payment gateways and payment service providers (PSPs) used interchangeably but they are different.

PSPs (aka merchant service providers, payment processors or ISOs) are companies that provide a range of services that help businesses accept payments whereas a gateway is software carrying out a specific service in the payment process.

Many PSPs combine payment gateways and merchant accounts into one package and take a nice premium for the convenience of doing so (which is why it is often worth looking at getting your own payment gateway provider and a separate contract with a merchant account provider which can often lower transaction fees).

Most payment processors will charge higher fees for online sales than face to face payments with additional risk associated with ‘card holder not present’ payments often being used as a reason. However, in most cases there should be no need to pay more for online card processing than in-person payments received via a POS terminal.

What is the cheapest payment gateway?

You should avoid trying to find the payment gateways with the lowest fees as this is likely to cost you more in the long run. Of course price is important but you need to weigh up the fees against potential losses incurred by going down a more budget route.

If a payment gateway’s lower costs are outweighed by the money you end up losing on expensive chargebacks it might not be worth that investment.

A poor checkout experience due to a poor gateway will also cost you in lost sales so going for the cheapest is often a false economy.

It depends. Sorry we can’t give a definitive answer but it really depends on your company and level of card turnover.

Most payment gateway providers bundle payment processing services into their offering. This means that they will also provide you a merchant account and the transaction fees will be set by them (which is how they make a large portion of their income).

However, you can get just get the payment gateway software by itself which will easily integrate with your preferred merchant account provider. These providers are acquirer agnostic and don’t force you to accept the fees of a certain merchant account provider.

Just know that you can shop around for the best UK payment gateway and have a merchant account from another company in order to secure better card processing rates (you integrate them with your merchant ID number).

If you find that your preferred payment gateways lack one or two key features and none cover all your requirements it may be worth combining more than one. For example, you may want add functionality so you can accept Amex, Apply Pay, multiple currencies or recurring payments and therefore sign up to multiple providers.

Adding payment options your customers want via multiple payment gateways will cause less friction at checkout and could increase conversion rates.