Merchant Acquirers

Whilst there are over 100 merchant card acquirers and over 50 payment facilitators providing services to UK businesses 97% of UK card transactions are processed by just 11 merchant acquirers and 3 payment facilitators.

Over 95% of UK businesses with an annual card turnover above £60,000 sign up with a merchant acquirer or merchant service provider. The other 5% use a payment facilitator (e.g. Square, Zettle) and these tend to be the low card turnover businesses.

What Is A Merchant Acquirer?

A merchant acquirer is a licensed bank or other financial institution that handles the processing of card payments on behalf of a merchant. Merchant acquirers are also known as acquiring banks or merchant banks.

They provide businesses with their dedicated merchant account and maintain the necessary card scheme membership relationships with Visa, Mastercard, Amex and the other card schemes (i.e. Diners, JCB etc).

What do they actually do?

An acquiring bank facilitates a sales transaction, receives the merchant’s requests for payment authorisation and directs them to the issuing bank for approval or rejection. If the issuing bank approves the payment, the merchant acquirer receives the money and transfers it to the merchant’s bank account.

The acquiring bank also processes refunds and returns for the merchant and pays the card scheme fees for using the payment networks, such as Visa, Mastercard and American Express.

They are suitable for micro-businesses with annual card turnover above £20,000 all the way up to large multinationals with turnover above £50 million.

Customer Sign-Up / Onboarding:

Most merchant acquirers use corporate bank referrals and Independent Sales Organisations (ISOs) like Handepay, Takepayments etc to attract and sign up UK SMEs (see the section below on the most popular ISOs).

Higher turnover businesses will likely have far more negotiating strength in dealing with merchant acquirers directly.

Typical Merchant Acquirer Fees

Acquirers and their ISO partners don’t publish the fees for their card-acquiring services. Their pricing structures and headline rates vary significantly which make it difficult for UK business to compare payment processors.

Transaction fees are variable and dependent on several factors (i.e. annual card revenue, average transaction value, business sector, risk of chargebacks etc). Some acquirers offer fixed transaction fees for low card turnover businesses but they are costly and have volume restrictions making them unfeasible for most businesses.

They do tend to publish fixed monthly fees for use of their payment gateway and card terminals. The merchant service charge (MSC), which is the total fee merchants pay to acquirers for card-acquiring services, will vary significantly and can be negotiated.

We are able to get preferential rates from merchant acquirers so please try us if you are looking to reduce your fees (we can normally offer lower costs than going direct or using an ISO).

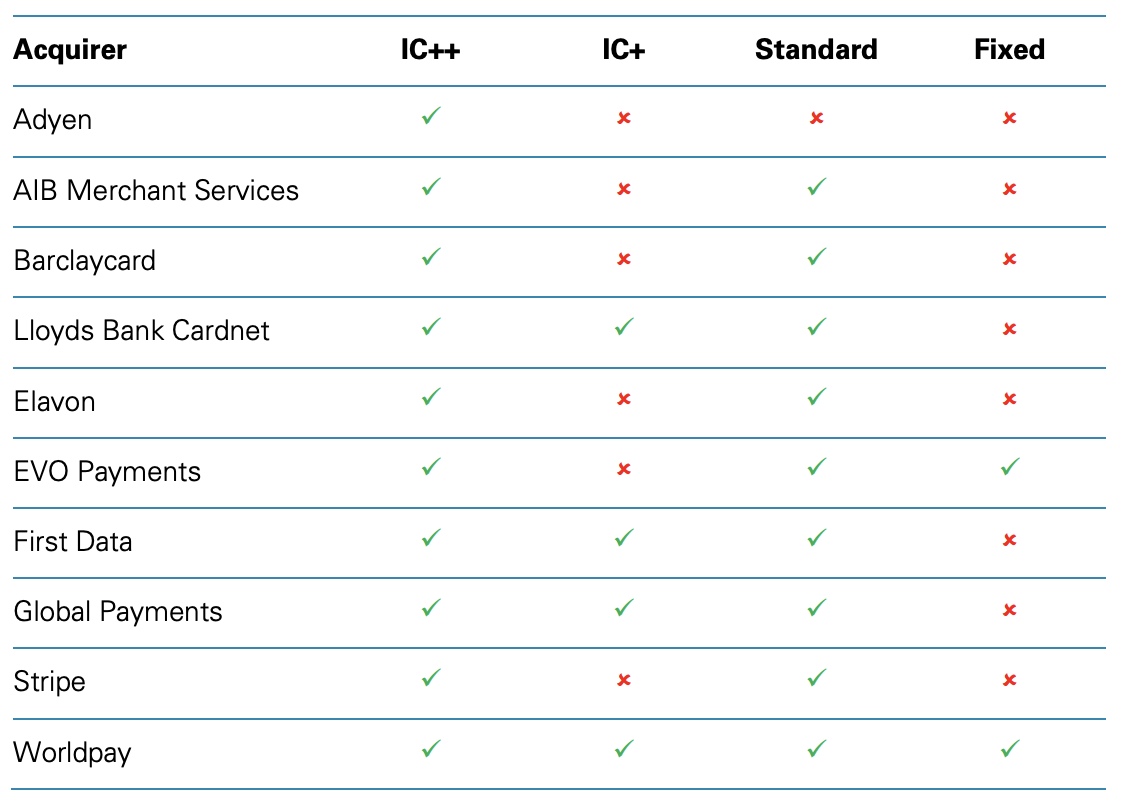

Acquirer Pricing Options

Unless you are a large merchant you are likely to be offered transaction fees based on a standard pricing model. Businesses with very low card turnover may qualify for fixed pricing but the rates will not be competitive. We cover the components of card processing fees here.

The higher your annual card revenue is above £20,000 the more you will save using a dedicated merchant account provider versus a payment facilitator like Zettle, Sumup, Square, Paypal or Stripe.

How do merchant account providers make their money?

The biggest 5 acquirers (Worldpay, Barclaycard, Lloyds Cardnet, Elavon and Global Payments) make their revenue from the following channels:

- 62% from variable fees charged for card-acquiring services

- 23% from fixed fees charged for value-added services such as dynamic currency conversion or helping compliance with PCI DSS are the second-largest revenue stream

- 15% from fixed monthly fees charged for supplying card terminals and payment gateway software

List Of UK Merchant Acquirers

| AIBMS | Credorax | Safecharge |

| American Express | Elavon | Trust Payments |

| Bank of Ireland (Evo Payments) | First Data / Fiserv | Truevo |

| Barclaycard | Global Payments | Valitor |

| Borgun | Lloyds Bank Cardnet | Clearhaus |

| CashFlows | PaySafe | WorldPay |

How and where do merchant acquirers fit into the payment cycle?

An acquiring bank sits between the merchant and the customer’s card scheme and issuing bank, providing a secure framework to verify transactions and prevent fraud.

In the seconds after a customer taps a contactless payment card on a terminal, enters a pin number, or clicks confirm on an online order, the merchant acquirer handles:

- Customer authentication. The acquirer checks the identity of the cardholder, the validity of the card and whether the card account holds enough money to cover the purchase.

- Payment authorisation. If the card is authenticated by the relevant card scheme, the issuing bank authorises the merchant acquirer to go ahead with the transaction.

- Settlement. Once the payment is authenticated and authorised, the acquirer transfers the money from the cardholder’s account to a merchant account to hold it on behalf of the merchant. It then subtracts its processing fees and sends the remaining money to the merchant’s bank account.

Merchant acquirer service providers assume the risk of dealing with fraud and customers charging back purchases, effectively guaranteeing the merchant’s account.

Why do I need a merchant acquirer?

Some issuing banks provide merchant acquiring services, but they typically charge high fees and require merchants to sign long-term contracts.

Accepting payments without an acquirer is possible if a merchant chooses a payment facilitator like Paypal, Zettle or Square, rather than taking card payments directly, as these providers interact with the issuing banks.

What should I ask a potential acquirer?

It’s important to understand the services a merchant acquirer offers and whether they’re compatible with your business needs.

In reality, you are unlikely to deal directly with an acquirer and will use an ISO that recruit merchants on behalf of an acquiring bank and takes a % of the merchant transaction fees as payment for their sales and customer service work.

Questions to ask include:

- Which payment cards and methods does it accept?

- Which payment gateways does it work with?

- Which countries and currencies does it support for payments and settlements?

- Does it comply with Payment Card Industry Data Security Standard (PCI DSS) regulations to maintain a secure environment for processing payment information?

- Does it offer fraud protection measures like Visa’s 3D Secure, which requires customers to authenticate their identity?

- What is the settlement period for transferring funds from the merchant account?

- Does it support recurring transactions?

- How does it provide customer support?

- What are its fees and how are they structured?

FAQs

What’s the difference between an acquiring bank and an issuing bank?

Acquiring banks and issuing banks operate at different stages of the payments process. A merchant acquirer processes debit and credit card transactions on behalf of a seller, while an issuing bank issues cards to consumers and approves payments from the card accounts.

An acquiring bank is therefore like a middleman for the merchant, whereas an issuing bank provides services for the customers.

What questions should I ask a card acquirer before signing up?

If the cars acquirers don’t provide a transparent run-down of their charges, ask them to confirm the following fees:

- Application and account setup costs

- Recurring account charges

- Transaction fees for customer authorisation and money transfer

- Transaction fees for certain payment methods, e.g. foreign issued cards, credit cards

- Currency conversion fees

- Settlement charges

- Transaction limits

- Processing costs for refunds, chargebacks or disputes

- Charges for account features

Many small and medium-sized enterprises (SMEs) aren’t getting the best deal from their merchant acquirer. According to a report by the Payment Systems Regulator in 2020, SMEs tend not to negotiate good terms or switch to another acquirer to save on costs. This is what our company helps you to do.

That’s little surprise, as it can seem daunting to get to grips with the breadth of information out there about card processing and payment services.

How do I pick the right merchant acquirer for my business?

If you fill in out our short form we can help you find the best merchant acquirer for your business.