On this page

Process more than £25K per year?

Card machines with a merchant account will normally be the better and cheaper option. Click below to compare the lowest transaction fees available for your business.

Compare payment processors and secure the lowest payment processing fees for your business

You'll only deal with us. We are not a lead generation company.

No multiple sales agents. No call centres. No referring your details.

Compare payment processors and secure the lowest payment processing fees for your business

What we like:

Things we don’t like:

Zettle by PayPal (previously iZettle) is an award-winning Swedish fintech and one of the most popular choices for small businesses in the UK looking for pay-as-you-go card machines.

It was bought for $2.2bn by Paypal in 2018 who dropped the ‘i’ and rebranded it to Zettle by Paypal in Feb 2021.

Its mobile card reader means you can accept payments almost anywhere and its excellent POS app packs a powerful collection of payment and business management tools.

This doesn’t mean Zettle’s mobile card reader is going to be for every kind of business, though. So, in this review, we’re going to look at the good and bad of Zettle’s card reader – and explain what kind of businesses should consider using it.

Before you can order your Zettle card reader, you’ll need to sign up for Zettle and then get your bank account approved. The signup process takes no time at all – you simply fill in some information about your business and then Zettle performs a “unique risk assessment,” including a credit check and identity verification.

First, we used a business bank account with a good history of receiving payments, paying out for expenses and making a healthy profit. Then, we registered with a sole trader account and had no problems getting approved, although some customers have told us they had to provide additional documentation when registering with a sole trader account.

All in all, signing up and getting approved is straightforward and the experience is very similar to getting started with Square – both of which are faster than SumUp.

Once you’ve signed up with Zettle, you can order your card reader and it should arrive within 1-3 days with free delivery. We only had to wait two days to receive our reader and DHL sent us a text message the day before to tell us it was coming and that we’d need to sign for it.

Zettle User Experience

When you open the box containing the entire package, you’ll find your Zettle card reader with a USB cable, which you can plug in to start taking payments right away.

There are two ways to take payments:

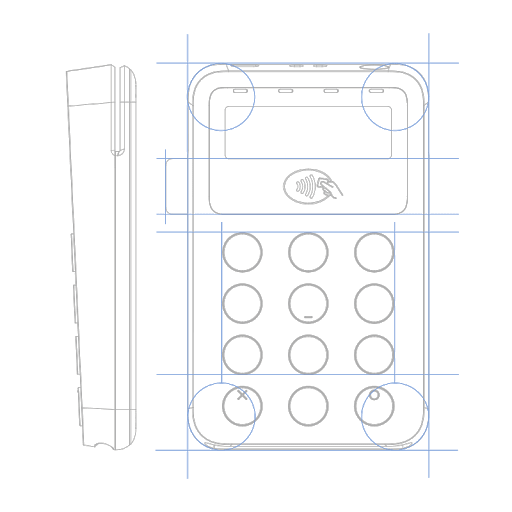

Another key difference is you’ve got a keypad on the Zettle reader, which you don’t get with Square’s key-less mobile reader.

Zettle’s card reader is noticeably larger when you compare the two but there’s not a great deal in it. What’s more noticeable is that Zettle has managed to squeeze a keypad into a device that’s slightly larger but better equipped to take payments.

To take your first payment, you’ll need to pair your card reader with your Bluetooth-enabled iOS or Android device. This only takes a moment using the Zettle POSapp and you’ll be guided through the entire process in-app.

Once you’re set up, you can enter the amount of the sale and tap the “charge” button. This sends all the payment details to your card reader and all your customer needs to do is insert their card to pay by chip and pin or hover their card/device over the NFC icon for contactless or mobile payments.

One of the key selling points of Zettle is that it’s the fastest mobile card reader on the market. The device only takes two seconds to power up and contactless/mobile payments should be completed within 5 seconds. Other payments may take up to 15 seconds but you’re still looking at impressive times compared to most card readers on the market.

This can make a real difference when you’re dealing with queues or customers in a rush.

With your first payment complete, your funds should be in your bank account within 1-3 business days. This is faster than SumUp but slightly slower than Square, which promises to have funds in your account as soon as the next business day, as well as offering an instant deposit feature for a 1% fee.

As for the battery lifetime and durability, Zettle Card Reader 2’s battery lasts 8 hours or 100 transactions on one charge. The USB charging cable is included in the package.

Much like Square and SumUp, Zettle’s mobile card reader is designed for small businesses that accept a low volume of card payments per month. In summary, this would be:

If you’re in this category then using a payment facilitator like Zettle may be the best option.

However, if you’re processing more than £2,000 in card payments per month, then the lower fees per card transaction offered by merchant account providers may be significantly cheaper. Essentially, it all comes down to how much you’re going to take through card payments per month. You can see a breakdown of the different costs associated with buying or renting a card machine here.

Regardless of your business size, if the vast majority of your transactions are cash and you only need to take the occasional card payment, Zettle is a strong contender.

The same thing goes for new businesses that aren’t ready to process high volumes of card payments yet.

In most cases, their customers are small retailers or in the hospitality business: pubs, cafes, B&Bs, etc. However, the mobile card reader makes this an ideal choice for businesses or professionals that need to visit customers on-site or in their homes – for example, plumbers, gardeners and interior designers.

Something else that’s worth bearing in mind is that with payment facilitators like Zettle, Square and SumUp you don’t need a merchant account to accept card payments. This makes it significantly easier and quicker to get set up and start transacting than using traditional merchant account providers.

While this mobile card reader allows you to accept payments pretty much anywhere, there are a lot of other payment and business management features built into the Zettle POS.

Here is the list of features that you get from your Zettle card reader:

Zettle Card Reader 2 is compatible with the following platforms and systems:

You’ll be able to accept the following cards in the UK:

Aside from the card reader itself, Zettle also offers a range of payment and software features in its two POS apps.

First, you have the Zettle Go app, which gives you the following features for free:

Update: Zettle Food & Drink will retire on 31st December 2021 and they will be promoting their Go POS app in its place.

In combination with the Zettle Reader 2 it can:

They are also promoting integrations with other POS systems like Lightspeed, Vend and Tabology.

Zettle Go & Tabology

Ideal for Drink-led venues with POS terminals in up to 15 sites (e.g. pubs, gastro pubs, bars, breweries, clubs, event spaces, performance venues and QSR)

As far as we’re concerned, it’s a little disappointing that you can’t accept payments on your website with the free version of Zettle Go – something you can do with Square at no extra cost. In fairness, Zettle offers the stronger set of eCommerce and inventory options if you pay for the PRO version but there’s no virtual terminal at all.

So, if you want to accept payments on your website and over the phone, you should probably take a look at Square’s mobile card reader as the accompanying app offers both of these for free.

Zettle POS systems are able to integrate and sync with a wide range of third-party apps and systems to facilitate everyday tasks and help you continue using any systems you may already have in place.

Integration options Zettle offers include:

Zettle is instantly off to a good start with its transparent pricing model, which means you don’t need to worry about hidden costs, contract termination fees or getting stung for having to refund your customers.

Zettle’s transaction fees are currently at 1.75% in line with its two main rivals, Square (1.75%) and SumUp (1.69%) which target the same customer base.

Aside from that, you don’t need to worry about monthly fees (unless you choose to pay for the Go PRO app), contracts, cancellation fees or any hidden surprises. You also won’t be charged for refunds and they’ll even refund your transaction fees if you run into any problems with customers.

Another big plus is you won’t be charged any extra for taking payments from foreign cards and this makes their extensive support for card issuers all the more impressive.

Security

Zettle card reader is EMV (Europay, MasterCard and Visa) approved and adheres to the Payment Card Industry Data Security Standard” (PCI DSS) for handling card data and providing a secure network to all users.

Also, your customers’ credit card data is encrypted by Zettle’s HSM cryptographic servers.

In a case of a customer dispute, Zettle provides transaction protection that covers up to £250 in eligible monthly chargebacks.

The card reader’s systems monitor every processed transaction for fraud even before it happens. The traffic is evaluated for suspicious activity and, if the service detects signs of abuse, the user’s account is immediately terminated.

Finally, PayPal – Zettle’s parent brand – is licensed and under the supervision of Luxembourg’s financial sector authority, Commission de Surveillance du Secteur Financier, which requires all of PayPal’s and Zettle’s staff to keep your business data safe.

Payment services companies can really let you down when it comes to customer service but

You’ll also find a fairly thorough support section on the website, which will guide you through all of the basics of using Zettle and the most common problems customers run into. However, it’s worth noting you won’t get an instant response over the weekends.

We’ve heard some complaints about their support team not being available or being a little slow to deal with technical issues. If you need to speak to someone, you can call support Monday to Friday, between 9am and 5pm or fill out the contact form on the their website.

Aside from these two potential issues, their reputation among existing customers is very positive and there aren’t many payments service companies we can say that about.

| Square | Zettle by Paypal | SumUp | |

|---|---|---|---|

| Device cost | £16 + VAT | £19 + VAT | £29 + VAT |

| Transaction fees (chip-and-pin) | 1.75% | 1.75% | 1.69% |

| Settlement time | Instant (1% fee) or as soon as the next business day | 1-2 business days | 2-3 business days |

While SumUp offers the cheapest flat rate, PayPal Here can work out as the most affordable option if you’re processing enough payments. The problem with PayPal is it has by far the worst reputation for customer service among these companies, receiving quite a lot of complaints about funds being held for an extended period of time.

Then you have Zettle and Square, which are essentially going to cost you the same on a monthly basis. What sets these two apart, though, is they also provide free, heavily-featured POS platforms in addition to their card readers.

If you don’t already have a POS system on board and these two can provide the features you need, you’re probably looking at the best overall packages for small businesses with low volumes of card transactions.

Whilst they Zettle and Square both offer their own impressive POS features, Square offers more features for free but the paid Zettle Go PRO app comes with a number of eCommerce solutions you can’t get from Square.

Process more than £25K per year?

Card machines with a merchant account will normally be the better and cheaper option. Click below to compare the lowest transaction fees available for your business.

You may also be interested in:

Legals

Copyright © ALL RIGHTS RESERVED 2025

Address: Spaces, 9 Greyfriars Rd, Reading, RG1 1NU

Company Number: 09017066

Compare Payment Processors