Compare Payment Processors

Compare payment processors and secure the lowest payment processing fees for your business

- Receive preferential rates from trusted payment processors

- Compare multiple merchant service providers from a single source

- Back up support throughout the agreement with the provider you choose

You'll only deal with us. We are not a lead generation company.

No multiple sales agents. No call centres. No referring your details.

Compare payment processors and secure the lowest payment processing fees for your business

Payment Gateway vs Payment Processor: What Is The Difference?

The terminology in the payment’s industry can be confusing. Many terms are used interchangeably and most merchant service providers can’t be neatly allocated into just one category.

We’ll try to untangle some of the confusion and clarify how we define the similarities and differences between payment gateways and payment processors.

Contents

What is a Payment Gateway?

A payment gateway acts as the interface that collects and transfers payment information from a customer to a merchant acquirer (also known as an acquiring bank).

It then communicates whether a payment has been accepted or declined back to the customer.

You’re likely to come across a payment gateway whenever you try to complete a transaction online.

How Does a Payment Gateway Work?

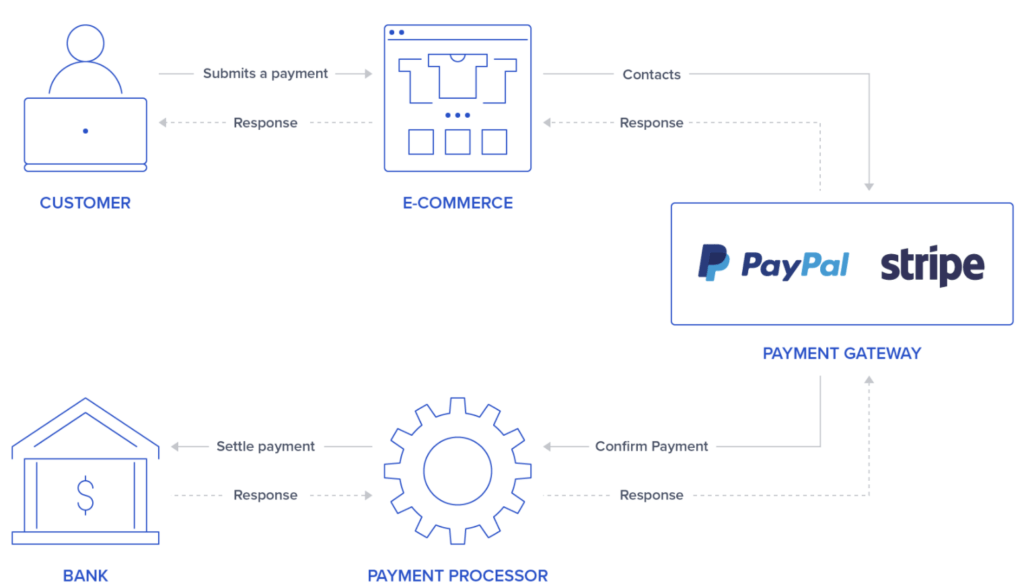

A payment gateway is a mid-point between a customer and a merchant. It collects and validates customer payment details, communicates with the customer’s bank to ensure the funds are available, and then transfers that information onwards to the payment processor and acquiring bank.

The following steps are a typical illustration of how payment gateways work:

Step 1: A customer enters their payment information on the checkout page of an online store.

Step 2: The payment gateway collects and encrypts that information, before sending it on to the merchant acquirer.

Step 3: The acquiring bank uses a payment processor to forward the request to the customer’s bank, which approves or denies the transaction.

Step 4: If the transaction is approved, the payment gateway confirms with the customer and finalises the sale. The gateway may also display a confirmation screen if the customer’s bank uses 3D Secure authentication.

Payment gateway providers often make it easy to integrate their solution into various e-commerce platforms, and may also provide an API for custom integrations.

Types of Payment Gateways

Different payment gateways have their own distinctive ways of working, and you should carefully consider which solution will best suit your needs.

The most common types of payment gateways are:

- On-site Checkouts: Some payment gateways can provide customers with a seamless experience that doesn’t redirect them to another site or open a separate window. In such cases, payment processing is handled through the system’s own backend.

- Off-site Redirects: Certain payment gateways and systems redirect customers to another website or application. In these cases, they will be taken away from the merchant’s site to check out and process the payment.

- On-Site Checkouts with Payment Processing: Merchants that use fully integrated solutions can use their own systems to complete the checkout and payment processing cycle.

Which is the Best Payment Gateway in the UK?

There are plenty of important factors to consider when choosing between different payment solutions. While each provider offers a slightly different service, the best payment gateway for your business will be the one that most closely meets your needs.

Some of the most popular payment gateways in the UK include:

Visit our guide to the best payment gateways to find out more, or complete our short form to contact us for advice.

What is a Payment Processor?

A payment processor is a company that transmits the information collected by a payment gateway between the acquiring bank and the customer’s bank.

How Does a Payment Processor Work?

Once a customer submits their details through an online store’s checkout, the payment gateway encrypts the data and forwards it to the payment processor. The transaction then proceeds through the following steps:

Step 1: The processor sends the information to the customer’s bank for approval or denial.

Step 2: The issuing bank approves or denies the transaction based on whether a) it is permitted and b) the customer has sufficient funds to make the payment.

Step 3: The issuing bank communicates the decision to the customer via the payment gateway.

Step 4: If the payment is approved, the processor will transfer the payment information to the acquiring bank.

Examples of Payment Processors

There are many payment processors that provide their services to businesses based in the UK, and it’s worth considering your options before making an application.

Notably, some companies that offer payment gateways also offer payment processing services. Whether you should choose a separate payment gateway and payment processor or choose a combined solution will depend on your unique requirements.

Some of the most popular payment processors in the UK include:

- Worldpay / FIS

- Fiserv

- Adyen

- Clover

Some major e-commerce platforms (such as Shopify and WooCommerce) offer their own payment processing capabilities, while businesses such as BitPay can process payments made with cryptocurrencies.

Payment Processor or Payment Gateway: Do You Need Both?

In a word, yes. There’s no payment processor vs payment gateway argument to be had, since you will need both to handle online and in-person transactions.

The question is whether you should use one company to do both or separate companies to carry out each function.

Payment gateways provide an interface that collects and secures customer data, confirming whether a transaction has been approved or rejected on the checkout screen or via an external site. Payment processors transmit this information between the customer’s bank and the merchant acquirer.

Transactions cannot be processed and completed without both elements.

What to Look for in a Payment Gateway and Payment Processor

When looking for a payment gateway or payment processor, businesses should review their options and match the features offered with their commercial needs.

Important Features for Payment Gateways

Some of the most important features to look for when choosing a payment gateway include:

- Strong Security: Security should be of paramount concern to any business operating online. It’s essential to keep customer data safe, which is why you should seek a payment gateway with strong security credentials. When comparing providers, ensure that they are PCI compliant.

- Uptime: Many businesses sell their services online to reach a wider audience and to be available 24/7. It is worth finding a payment gateway that can match that uptime and facilitate payments at all times of the day.

- Fraud Detection: Many payment gateways come equipped with fraud detection systems that analyse transactions and actively prevent fraudulent behaviour. To limit chargebacks and avoid fraud, you should seek out a payment gateway that actively seeks to identify and protect against fraudulent transactions.

- Payment Options: The more payment options you can accept, the more customers you can sell to. It’s worth finding a payment gateway that can handle transactions using a variety of payment methods including debit and credit cards, eWallets, but also numerous international currencies.

- Integration Options: Whether you’re seeking pre-built integration with an e-commerce platform or a custom solution using an API, you’ll need to ensure that your chosen payment gateway can work with your website.

Important Features for Payment Processors

The following are some of the key things to consider when choosing between payment processing providers:

- Processing speed: Transaction speed is an important factor in customer retention efforts. Your business should seek a payment processing partner that can execute online transactions in good time.

- Fees: Payment processors use their own fee structures, and typically charge based on payment volume and transaction value. Businesses should seek partners that offer competitive rates that suit their financial needs.

- Payment Options: In common with payment gateways, merchants should ensure that they partner with a payment processor that can execute payments made using a variety of methods and in an array of currencies.

How to Choose the Best Payment Gateway and Payment Processor

Whether you’re looking for a new payment gateway or a payment processing provider, the key to choosing the best option is to match the features offered with your business’s unique needs.

We are payment processing experts, and draw on a wide network of contacts and connections to help our clients find some of the market’s most effective and competitive payment solutions.

To find out more, contact us for help and advice or detailed quotes for services that will suit your business.

Payment Gateway vs Payment Processor FAQs

Is a payment processor the same as a payment gateway?

No. While they are conceptually similar, a payment gateway is an interface that sits on top of a website’s checkout to securely collect payment information and communicate whether transactions are approved or denied. Payment processors, on the other hand, transmit the payment details between the customer’s and merchant’s banks and execute any transactions that are approved.

Does my business need a payment processor and a payment gateway to process credit cards?

Yes, you will need both a payment gateway and a payment processor in order to accept card payments online. Depending on your requirements, you may be able to apply for a packaged solution that encompasses both a payment gateway and payment processing services from the same provider.

On this page

Compare Payment Processor Fees

Compare preferential rates and card processing offers from the UK’s leading merchant account providers

You’ll only deal with our in-house payment experts

Your details will not be shared

Legals

Copyright © ALL RIGHTS RESERVED 2025

Address: Spaces, 9 Greyfriars Rd, Reading, RG1 1NU

Company Number: 09017066