Compare Payment Processors

Compare payment processors and secure the lowest payment processing fees for your business

- Receive preferential rates from trusted payment processors

- Compare multiple merchant service providers from a single source

- Back up support throughout the agreement with the provider you choose

You'll only deal with us. We are not a lead generation company.

No multiple sales agents. No call centres. No referring your details.

Compare payment processors and secure the lowest payment processing fees for your business

SumUp Air Card Reader Review

Pros

- User-friendly app: Most users find the SumUp card reader app easy to use and set up.

- Fast payments: Payments are normally processed into business accounts quickly.

- Good customer support: SumUp users generally report that customer support reps resolved their issues promptly.

Cons

- ID Verification Issues: A few users had challenges with the ID verification process which delayed their application being approved.

- Lifespan of the devices: There were some reports of faulty card readers and issues with it no longer working after a relatively short period of time.

SumUp is a payment facilitator offering mobile card readers and online payment solutions for small businesses. This article is just going to cover their Sumup Air card reader and touch on their supporting services.

It is worth saying upfront this card reader is best suited to small businesses with an annual card turnover up to £50,000. If you likely to process more than this, then you are likely to save money leasing a card machine from a merchant account provider as the transaction fees are likely to be lower.

You can compare the typical costs associated with buying or renting a card machine here.

How Does SumUp’s Air Card Reader Work?

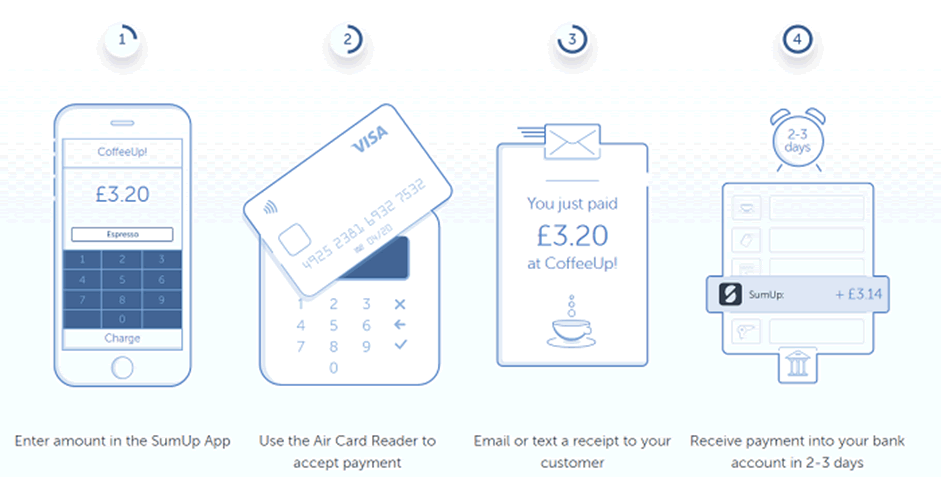

To get your SumUp Air Mobile Card Reader, you’ll first need to sign up on the company’s website and get your business verified. It’s easy enough to do – you simply need to fill out some basic information about yourself and your business.

SumUp will then perform a check against your business details before it approves your account, which is the standard process for payment companies like these. You shouldn’t have any problems being approved, as long as you’re not classed as a restricted business and your bank account is the same one being used for your business takings.

While you’re waiting for your business to be approved, you can order your card reader and you should receive it within 3-5 business days, by which time your business will probably be verified. The entire process shouldn’t take more than a week and our card reader arrived four business days after placing our order.

You can also download the free SumUp app for iOS and Android while you wait for your card reader to arrive and we’ll explain more about the app later in this review.

When your card reader arrives, you can start using it right away. All you need to do is switch on the device, enable Bluetooth on your phone or tablet and then go to the Payment Methods section of the app, where you can set up your card reader.

Once your reader is synced with your device it will automatically switch on when it’s in range of your mobile device and you select card payment at the checkout. You simply need to make sure your card reader is charged when you need it and SumUp’s automated integration works seamlessly.

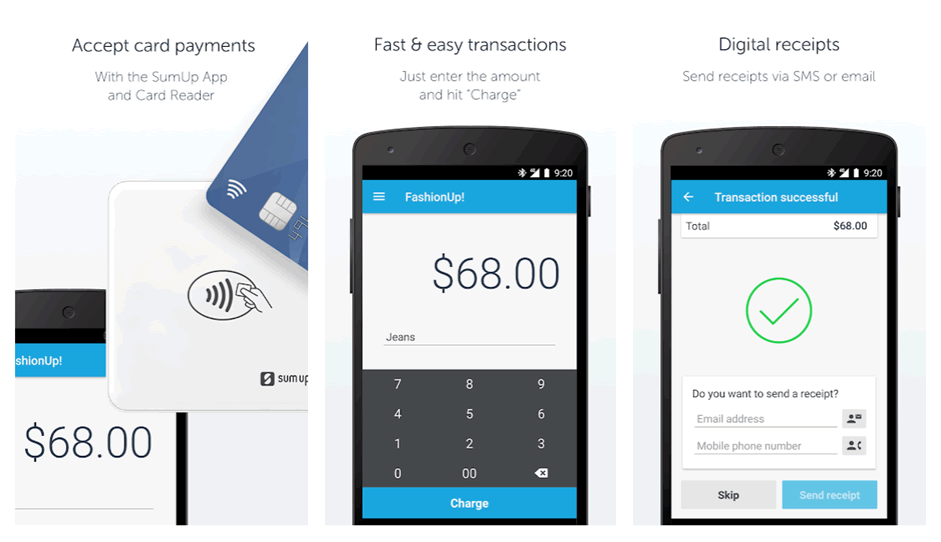

To accept payments, you can select from your list of products (assuming you’ve created an inventory) or manually enter a total amount for the transaction. If you’re manually entering amounts, you also have the option to type a description for these payments to help you with accounting.

When you’re ready to take the card payment, you click on the checkout section and hit the “Charge” button. At this point, you can either accept a cash payment (you need to enable this in your SumUp account first) or select card payment and the info will be sent to your card reader, as long as it’s in range.

At this point, your customers can pay with a Chip & Pin, contactless or mobile payment and you can expect to see the funds in your bank account within 2-3 business days. This is longer than it takes for both Zettle and Square to get funds into your account although SumUp isn’t exactly slow and we hear fewer reports of funds being withheld than PayPal Here, for example.

You can also choose to be paid weekly or monthly by setting up a schedule in your SumUp account.

What Kind Of Business Is SumUp Good For?

- Small businesses (less than £1,500 in card payments per month)

- New businesses

- Businesses that take the occasional card payment

- Food and drinks

- Hospitality

- Retail

- Mobile professionals: plumbers, roofers, etc.

SumUp’s 1.69% card transaction fees are easily the lowest among its rival mobile payment providers with Zettle and Square both coming in at 1.75% and PayPal Here being significantly more expensive, unless you process a high volume/value of transactions per month.

Volume is the key thing here because – even with SumUp’s low transaction fees – you’ll still get better rates elsewhere, if you’re processing a lot of card payments every month. This is where PayPal Here become a lot more competitive with its variable 2.75%-1.0% transaction fees.

Keeping this in mind, SumUp is best suited to smaller businesses that process a relatively small amount of card transactions per month.

Low transaction fees aren’t the only reason to use SumUp’s Air Card Reader, though. This is one of the few truly mobile readers that allows you to accept payments anywhere with a mobile connection. This can be vital to businesses that need to take payments from customers on the road and the ability to accept cash and card payments through the app is a big help when it comes to accounting and business management.

Features

As mentioned earlier in this review, SumUp’s Air Card Reader is very similar to the mobile readers offered by Zettle and Square. In terms of practical functions, these three readers are almost identical but there are a few differences worth noting.

Here’s what you get from your SumUp Air Mobile Card Reader:

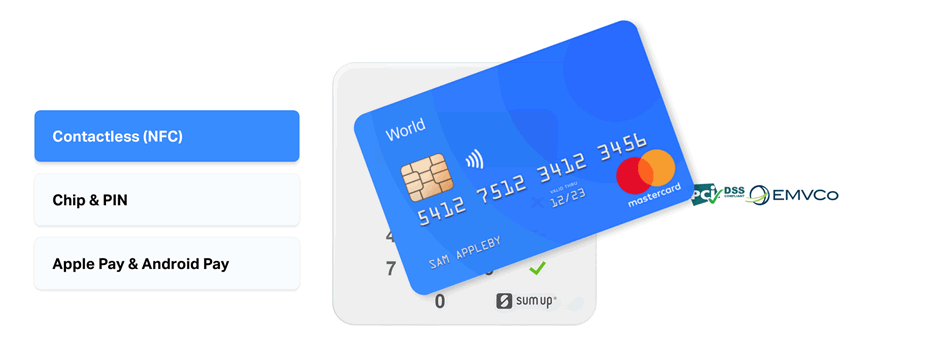

- Payments: Chip-and-pin, contactless and swipe payments.

- Mobile payments: Apple Pay and Android Pay.

- Wireless: Connect to Apple or Android devices via Bluetooth.

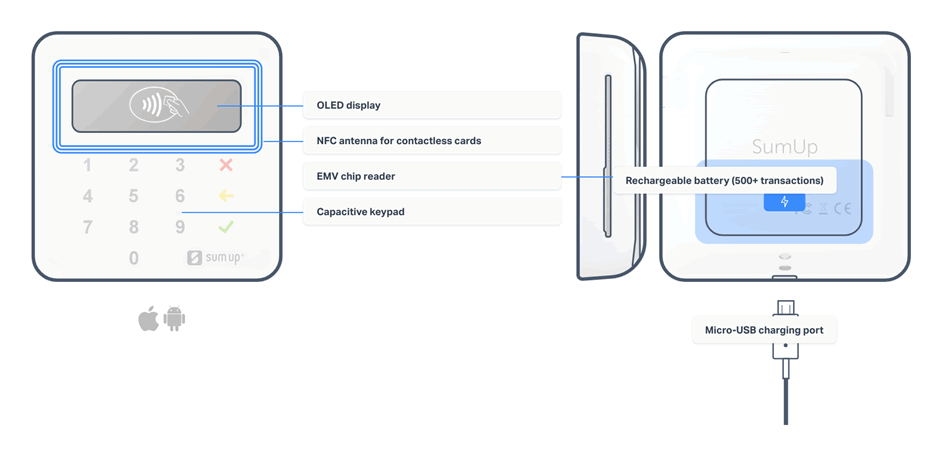

- Keypad: Customers can type their pin number in by using the card readers physical keypad.

- Battery life: 500+ transactions from a single charge.

In terms of payment support, SumUp’s Air Card Reader accepts cards from the following issuers:

- Visa

- Mastercard

- V Pay

- American Express

- Discover

- Diner’s Club

- Visa Electron

- Maestro

You also get mobile payment support for Apple Pay and Android Pay. This is a slightly better card support than Square offers but not quite as good as Zettle while both Square and Zettle also support Samsung Pay, which SumUp currently doesn’t.

As with iZettle’s card reader, you also get a physical keypad on your SumUp reader, allowing customers to type their pin number in on the device. With Square, there’s no keypad on the reader, which means customers will need to type their pin number in using your phone or tablet.

The other key difference is both SumUp and Zettle have a magstripe reader built into their mobile card readers while Square provides you with a separate reader that you need to plug into your mobile device – which can be a little cumbersome.

In terms of pure hardware, SumUp and Zettle offer the better mobile card readers but you also want to consider the supporting software features from each company.

SumUp’s mobile app is a lot more basic than those provided by Zettle and Square. While Zettle and Square offer fairly comprehensive POS system in their free mobile apps, SumUp’s mPOS is a separate paid service and this means you don’t get a great of features in the card reader’s accompanying app.

First, let’s take a look at what you can do with the app:

- Activate your account

- Manage your manage your products

- Create custom shelves

- Create staff accounts

- Send a receipt via email or text message.

- Easily resend receipts

- Optional ability to connect a printer and print receipts (see below)

- Sales history

- Custom Tax/VAT Rates

For more advanced features, such as discounts, tips and online payments, you’ll have to consider SumUp’s mPOS solution or get these features from another POS provider. The problem for SumUp is that Zettle and Square offer a lot of these features for free in their accompanying mobile apps.

If you need these features, SumUp’s low transaction fees might be cancelled out by the free features you get from Square or Zettle.

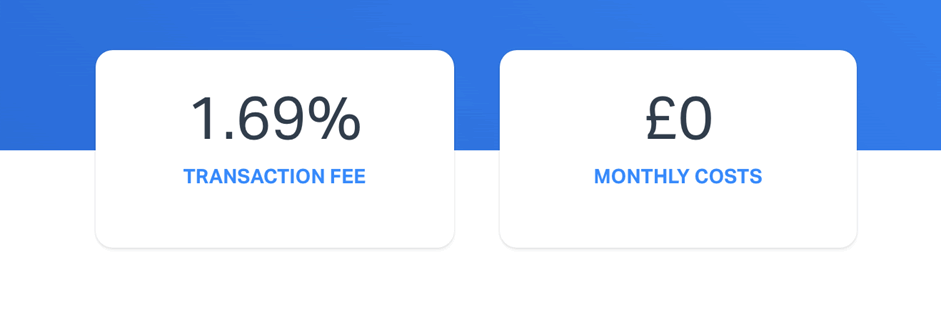

What are SumUp's fees?

SumUp’s charges a flat 1.69% transaction fee which are the lowest you’ll find among pay as you go card readers.

SumUp Transaction Fees

| Cost Type | SumUp Fees | Details |

|---|---|---|

| Transaction Fee (Standard) | 1.69% | Fee per transaction using the SumUp Air card reader. |

| Transaction Fee (Business Account) | 1.49% | Reduced fee for transactions with the SumUp Business Account. |

| Remote Transactions (Invoice/Link) | 2.50% | Fee for transactions processed through payment links or invoicing. |

| Monthly Costs | £0 | No monthly fees or rental costs associated with the device. |

| Virtual Terminal | 2.95% + 25p | Fee for card-not-present transactions processed without the card reader. |

| Online Payments | 2.50% | Fee for transactions processed through the online store or payment links. |

The standard transaction fees are 1.69% for card reader & business account transactions. However, if you also sign up to aSumUp Business Account, the card reader transaction fee is reduced to 1.49% and payments are typically received in just one business day compared to 2-3 with a normal account.

For remote transactions, such as those processed through payment links or invoicing, there’s a 2.50% fee. If you’re using the Virtual Terminal for card-not-present transactions, the fee is 2.95% + 25p. Finally, for online payments processed through the online store or via a payment link, the fee is 2.50%.

SumUp Card Reader Prices

The SumUp Air, priced at £34 + VAT. This connects via Bluetooth and supports magstripe, EMV/chip cards, and contactless NFC payments. It has an OLED display and a PIN pad, unlike the Square reader.

The SumUp Solo: £79 + VAT. This is a standalone terminal similar to the Square Terminal. It’s battery-operated with a colour touchscreen and accepts EMV and NFC-based payments. Connectivity is through Wi-Fi or a built-in SIM card.

SumUp Solo with a printer: £139 + VAT. This external printer attachment also acts as a separate battery pack extending periods between charges.

SumUp Customer Service

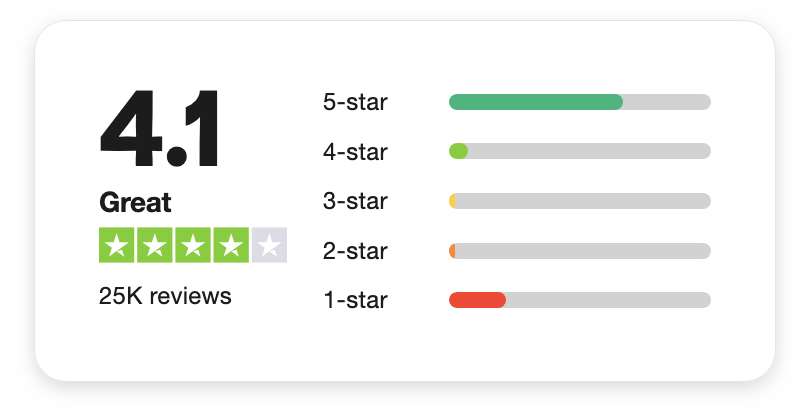

SumUp generally has a very positive online reputation although it seems the most common complaint revolves around funds being withheld. Essentially, some businesses find that after being initially accepted by SumUp, their funds are withheld and the company is asked to provide a number of additional business credentials.

However, looking into these complaints further, it appears these issues relate to companies that fall into SumUp’s “restricted businesses” category.

SumUp simply isn’t licensed to support these types of businesses and this it’s so important to read the terms and conditions before signing up. On the one hand, you could argue SumUp and other mobile payment providers should have a more rigorous application process but the trade-off would be making it making it more difficult for every business to sign up.

Complex applications are a common source of complaints among other payment providers.

Compare SumUp with our list of the best card readers for small businesses.

| Square Reader | PayPal Reader | SumUp Air | |

|---|---|---|---|

| Device cost | £19 + VAT | £29 + VAT | £34 + VAT |

| Transaction fees (chip-and-pin) | 1.75% | 1.75% | 1.69% |

| Settlement time | 3-5 business days or only 20 minutes if you pay an additional 1% fee. | 1-2 business days | 2-3 business days |

If pricing is your top priority, then SumUp is always going to be a tempting proposition. However, we’ve looked at a number of areas where the different feature offerings from SumUp’s rivals could make the slightly higher fees worth the expense.

It all comes down to knowing what you need from a mobile card reader and deciding what’s most important to you.

Verdict

SumUp’s Air Card Reader is well worth considering for businesses that don’t want to commit to a monthly contract and don’t process a high volume of card transactions.

If you are not using the card reader on the move, it is also worth checking out Square’s card reader which has better POS features included that can be used on a tablet.

On this page

You may also be interested in:

Legals

Copyright © ALL RIGHTS RESERVED 2025

Address: Spaces, 9 Greyfriars Rd, Reading, RG1 1NU

Company Number: 09017066

Legals

Copyright © ALL RIGHTS RESERVED 2025

Address: Spaces, 9 Greyfriars Rd, Reading, RG1 1NU

Company Number: 09017066