On this page

Process more than £25K per year?

Card machines with a merchant account will normally be the better and cheaper option. Click below to compare the lowest transaction fees available for your business.

Compare payment processors and secure the lowest payment processing fees for your business

You'll only deal with us. We are not a lead generation company.

No multiple sales agents. No call centres. No referring your details.

Compare payment processors and secure the lowest payment processing fees for your business

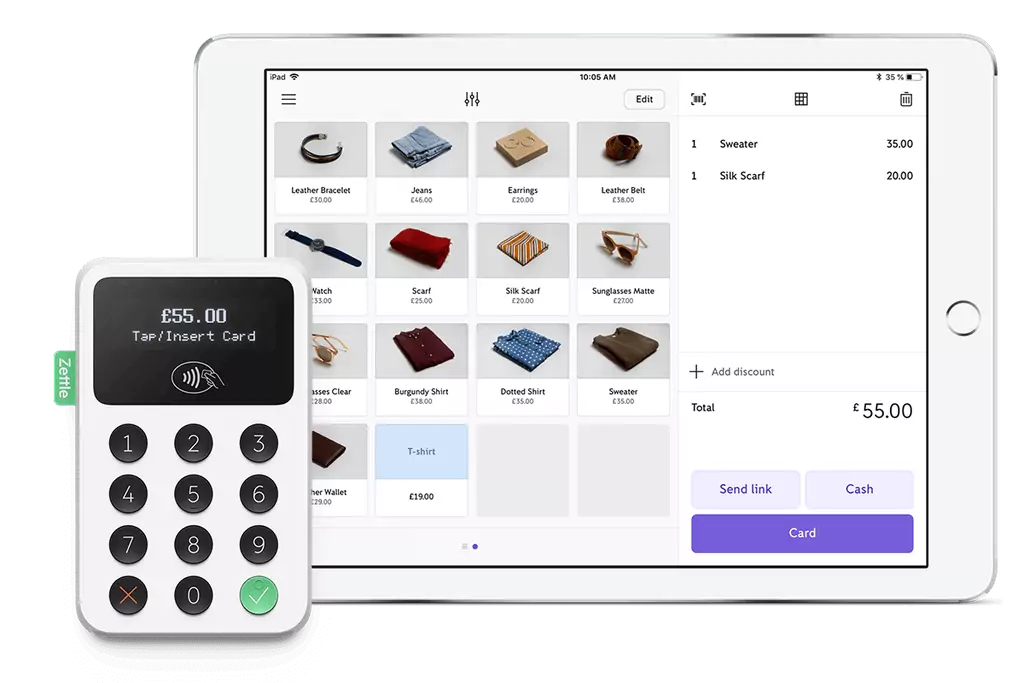

Square and Zettle offer two of the cheapest card machines and payment solutions for small businesses. In this head-to-head comparison review, we put the Square Reader against the Zettle Card Reader 2 so you can decide which solution is most suitable for your business.

Square and Zettle both offer affordable, portable card readers for accepting in-person payments – as well as additional software and hardware for accepting payments in-store and online.

Both companies provide something very similar so choosing between the two can be tricky, but this is why we’ve created this comparison.

Square Reader Pros

Square Reader Cons

Zettle Card Reader 2 Pros

Zettle Card Reader 2 Cons

Square and Zettle offer almost identical features with their mobile card readers.

| Square | Zettle 2 | |

|---|---|---|

| Chip and PIN | ✔ | ✔ |

| Contactless | ✔ | ✔ |

| Mobile payments | ✔ | ✔ |

| Swipe strip | ✖ | ✖ |

| ePOS | ✔ | ✔ |

| Virtual terminal | ✔ | ✖ |

| Wireless | ✔ | ✔ |

| Bluetooth | ✔ | ✔ |

| Reporting | ✔ | ✔ |

The one big difference is Zettle doesn’t include a payment gateway, which means you have no native option for taking payments over the phone. If this is important to your business, Square takes an early lead in this comparison.

Both companies also offer similar hardware options for you to build physical POS stations at your business.

| Square | Zettle 2 | |

|---|---|---|

| Charging dock | ✔ | ✔ |

| POS station | ✔ | ✔ |

| iPad stand | ✔ | ✔ |

| Cash drawer | ✔ | ✔ |

| Receipt printer | ✔ | ✔ |

| Barcode scanner | ✔ | ✔ |

| Receipt rolls | ✔ | ✔ |

| Bundle kits | ✔ | ✔ |

Square’s hardware is generally cheaper across the board but both offerings are highly affordable and the quality of Zettle’s hardware is slightly (but noticeably) higher.

| Square | Zettle 2 | |

|---|---|---|

| Size | 66 x 66 x 10 mm | 134 x 133 x 34 mm |

| Weight | 56g | 220g |

| Square | Zettle 2 | |

|---|---|---|

| iOS | iOS 9 +* | iOS 12 + |

| Android | Android 4.4 + | Android 5 + |

| Square | Zettle 2 | |

|---|---|---|

| Full charge | ~100 transactions | ~100 transactions |

| USB charging cable | Included | Included |

| Charging dock | £25 | £39 |

What card types do Square and Zettle take?

Considering Visa handles 82% of all card payments in the UK, both readers have you covered for the vast majority of situations but Zettle supports payments for JCB, UnionPay, Discover and Diners Club cards as well.

| Square | Zettle 2 | |

|---|---|---|

| American Express | ✔ | ✔ |

| Mastercard | ✔ | ✔ |

| Maestro | ✔ | ✔ |

| Visa | ✔ | ✔ |

| Visa Election | ✔ | ✔ |

| JCB | ✖ | ✔ |

| UnionPay | ✖ | ✔ |

| Discover | ✖ | ✔ |

| Diners Club | ✖ | ✔ |

| V Pay | ✔ | ✔ |

| Apple Pay | ✔ | ✔ |

| Google Pay | ✔ | ✔ |

| Samsung Pay | ✔ | ✔ |

Square and Zettle both offer free POS software solutions with paid options available for retail and food and drinks businesses. The free versions of each POS offer the same basic features while the paid versions offer specialist tools for table management, stock, orders and other tools to help you run your business.

The Zettle POS looks newer and more up-to-date but the paid versions of Square’s POS are more intuitive and flexible.

Zettle supports dozens of integrations for Shopify, WooCommerce, Lightspeed, Xero and plenty of other software options but Square supports hundreds of integrations through its App Marketplace – the clear winner in this category.

| Square | Zettle 2 | |

|---|---|---|

| Tamper proof design | ✔ | ✔ |

| Data encryption | ✔ | ✔ |

| PCI compliance | ✔ | ✔ |

| 24/7 support | ✖ | ✖ |

| Weekend support | ✖ | ✖ |

| Online documentation | ✔ | ✔ |

| Phone support | ✔ | ✔ |

| Email support | ✔ | ✔ |

Square and Zettle provide industry-standard security, including PCI compliance, and data protection protocols to keep you and your customers safe. You also get the same quality of customer service from both companies with email support and online documentation, plus phone support from 9 am to 5 pm on weekdays from both companies.

Zettle integrates with Shopify, WooCommerce, PrestaShop and Shopware to support online stores but it doesn’t provide any native eCommerce features other than processing online payments.

Square is different. You can integrate with eCommerce platforms like Shopify and WooCommerce but they also have their own ecommerce system which includes a payment gateway and online checkout.

It’s not the most sophisticated eCommerce solution although it’s great for small businesses that primarily sell in-store but want the ability to sell online such as restaurants looking to support online orders.

| Square | Zettle 2 | |

|---|---|---|

| Card reader | £16 | £29 |

| Transaction fees (in-person) | 1.75% | 1.75% |

| Online transaction fee | 1.9%-2.9% | 2.50% |

| Keyed-in transaction fee | 2.50% | N/A |

| Chargeback fee | ✖ | ✖ |

| Charging dock | £25 | £39 |

The square reader is cheaper in terms of hardware but they both charge 1.75% per in-person transaction. Square also charges less for online card-not-present (CNP) transactions.

For small businesses, both Square and Zettle will scale as you grow but the 1.75% transaction fees are relatively expensive compared to other merchant account providers. The trade-off is that these card readers are pay-as-you-go and require no monthly contract.

So, if you open branches across the country, you’ll get a better deal elsewhere as a high-volume merchant – fill out our form for custom quotes if this applies to your business.

With Square, you should receive your funds the next working day while deposits can take up to two working days with Zettle.

Both Square and Zettle are suitable for small businesses, primarily independent retail stores, food and drinks businesses or micro-businesses that need a mobile payment solution, such as food trucks or hairdressers visiting customers’ homes.

All things considered, Square offers a slightly cheaper package and provides key features if you need to take payments online or over the phone.

The Square Reader is also the smallest, lightest and most portable card reader on the market. Zettle isn’t far behind and the quality of its hardware is noticeably higher than Square’s, even if it’s half a step behind on the software front.

Either way, these are two of the best mobile payment solutions for smaller businesses and you have to split hairs to find meaningful differences.

Process more than £25K per year?

Card machines with a merchant account will normally be the better and cheaper option. Click below to compare the lowest transaction fees available for your business.

You may also be interested in:

Legals

Copyright © ALL RIGHTS RESERVED 2025

Address: Spaces, 9 Greyfriars Rd, Reading, RG1 1NU

Company Number: 09017066

Compare Payment Processors